Why Selling Your House with a Tax Lien Feels Impossible (But Isn’t)

Can I sell my house with a tax lien? Yes, absolutely – but it requires handling the lien properly during the sale process.

Here’s what you need to know:

- You CAN sell – A tax lien doesn’t prevent the sale of your property

- The lien MUST be satisfied – Either before closing or paid from sale proceeds

- Multiple options exist – From direct payment to negotiated settlements

- Cash buyers simplify everything – They handle the lien complexity for you

- Time matters – Ignoring a lien leads to penalties, interest, and potential foreclosure

Many San Antonio homeowners facing tax debt feel trapped and overwhelmed. The notices keep coming, the penalties keep growing, and selling your house seems impossible when you owe back taxes to Bexar County or the IRS.

But here’s what the government agencies don’t tell you upfront: you absolutely can sell your house even with an active tax lien. The key is understanding your options and choosing the right approach for your situation.

I’m Daniel Cabrera, founder of Sell My House Fast SA TX, and over my 16+ years in San Antonio real estate, I’ve helped countless homeowners steer the question “can I sell my house with a tax lien” and successfully close on their properties despite complex tax situations. The process doesn’t have to be as scary or complicated as it seems.

First, What Exactly is a Tax Lien in Texas?

Before we explore your options for selling, let’s clear up exactly what you’re dealing with. A tax lien is a legal claim the government places on your property when you owe back taxes. Think of it as the government’s way of securing their debt – they’re essentially saying “we’ll get paid when this property sells or changes hands.”

Here in San Antonio, most homeowners first encounter tax liens through unpaid Bexar County property taxes. Every year, you receive that property tax bill based on your home’s assessed value. These taxes fund our local schools, roads, and essential services. When those bills go unpaid, the Bexar County Tax Assessor-Collector’s office can place a lien on your property to ensure they eventually collect what’s owed.

But property taxes aren’t the only culprit. State tax liens can arise from unpaid Texas business taxes or other state obligations. Even more serious are federal (IRS) tax liens, which the IRS automatically places on all your assets – including your San Antonio home – when you owe federal income taxes and don’t respond to their Notice and Demand for Payment.

The moment any tax lien gets filed, it becomes public record. This creates what we call a “clouded title” on your property. Anyone who runs a title search – whether it’s a potential buyer, lender, or title company – will immediately see that lien attached to your home.

Here’s why this matters when you’re wondering “can I sell my house with a tax lien”: buyers and mortgage lenders want clean, clear titles. They want assurance that no one else has a legal claim on the property they’re about to purchase or finance. A tax lien signals there’s an outstanding debt that needs resolution.

Your credit score takes a hit too. Tax liens show up on credit reports and can make it harder to qualify for future loans or even rental applications. The longer the lien sits there, the more it affects your financial standing.

But here’s what’s important to understand: having a tax lien doesn’t mean you can’t sell your house. It just means the lien needs to be addressed as part of the sale process. Whether that happens before closing or gets paid from your sale proceeds, there are definitely ways to move forward and get out from under this burden.

So, Can I Sell My House with a Tax Lien in San Antonio?

Here’s the answer that brings relief to so many San Antonio homeowners: yes, you absolutely can sell your house with a tax lien. I’ve seen countless homeowners think they’re trapped, staring at those intimidating notices from Bexar County or the IRS, believing their home has become unsellable. But that’s simply not true.

The key thing to understand is that while a tax lien doesn’t prevent you from selling, the lien must be satisfied before you can transfer clear title to the buyer. Think of it this way – the taxing authority essentially gets in line ahead of you for the sale proceeds. They need to be paid their portion before you receive yours.

This is where your home equity plays a crucial role. If your San Antonio home is worth more than what you owe on your mortgage plus the tax lien amount, you’re in good shape. The lien can typically be paid off seamlessly at closing using the sale proceeds. Most homeowners find this to be the smoothest path forward.

But what if your equity isn’t enough to cover the lien? Don’t panic – there are still several options available, which we’ll explore in detail in the next section.

The title company or escrow agent becomes your best friend in this process. They handle all the complex paperwork, obtain payoff letters from the taxing authorities, and ensure every dollar gets distributed correctly at closing. They’ll contact Bexar County or the IRS directly to get the exact payoff amount, including any accumulated penalties and interest, so there are no surprises on closing day.

One thing that often catches San Antonio homeowners off guard is the timing. Getting accurate payoff information from tax authorities can take 30 days or more, which can delay your sale if you’re working through traditional channels. This is why many homeowners facing tax liens find that working with an experienced cash buyer simplifies the entire process.

The bottom line? Can I sell my house with a tax lien is definitely answerable with a yes, but it requires the right strategy and often professional guidance to steer successfully. Understanding who can put lien on a house can also help you better understand your situation.

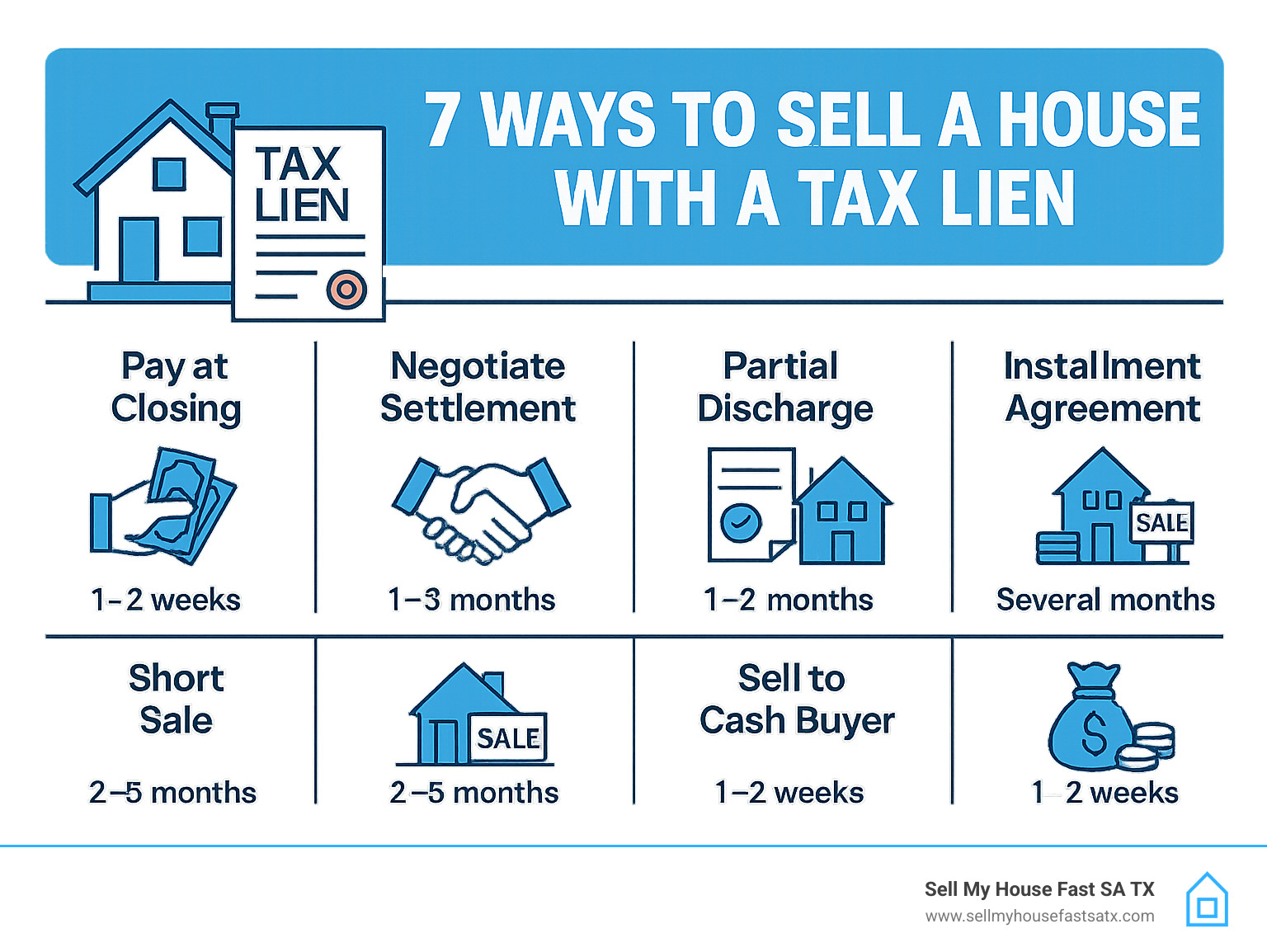

7 Ways to Handle a Tax Lien When Selling Your House

When you’re facing a tax lien, you have several paths forward. Each approach has its own timeline, complexity, and success rate. Let me walk you through seven proven strategies that San Antonio homeowners use to successfully sell their properties despite tax liens.

1. Pay the Lien Off Before You Sell

The most straightforward approach is paying off the entire tax debt before you list your property. This means writing a check to the taxing authority for the full amount owed, including any accumulated penalties and interest. Once paid, the government releases the lien, and your property title becomes completely clear.

This approach simplifies the sale process immensely. Potential buyers and their lenders don’t have to worry about any encumbrances, and you avoid potential complications down the road. However, this requires having readily available cash, which honestly isn’t realistic for most homeowners already struggling with tax issues. If you had the money sitting around, you probably wouldn’t be in this situation in the first place.

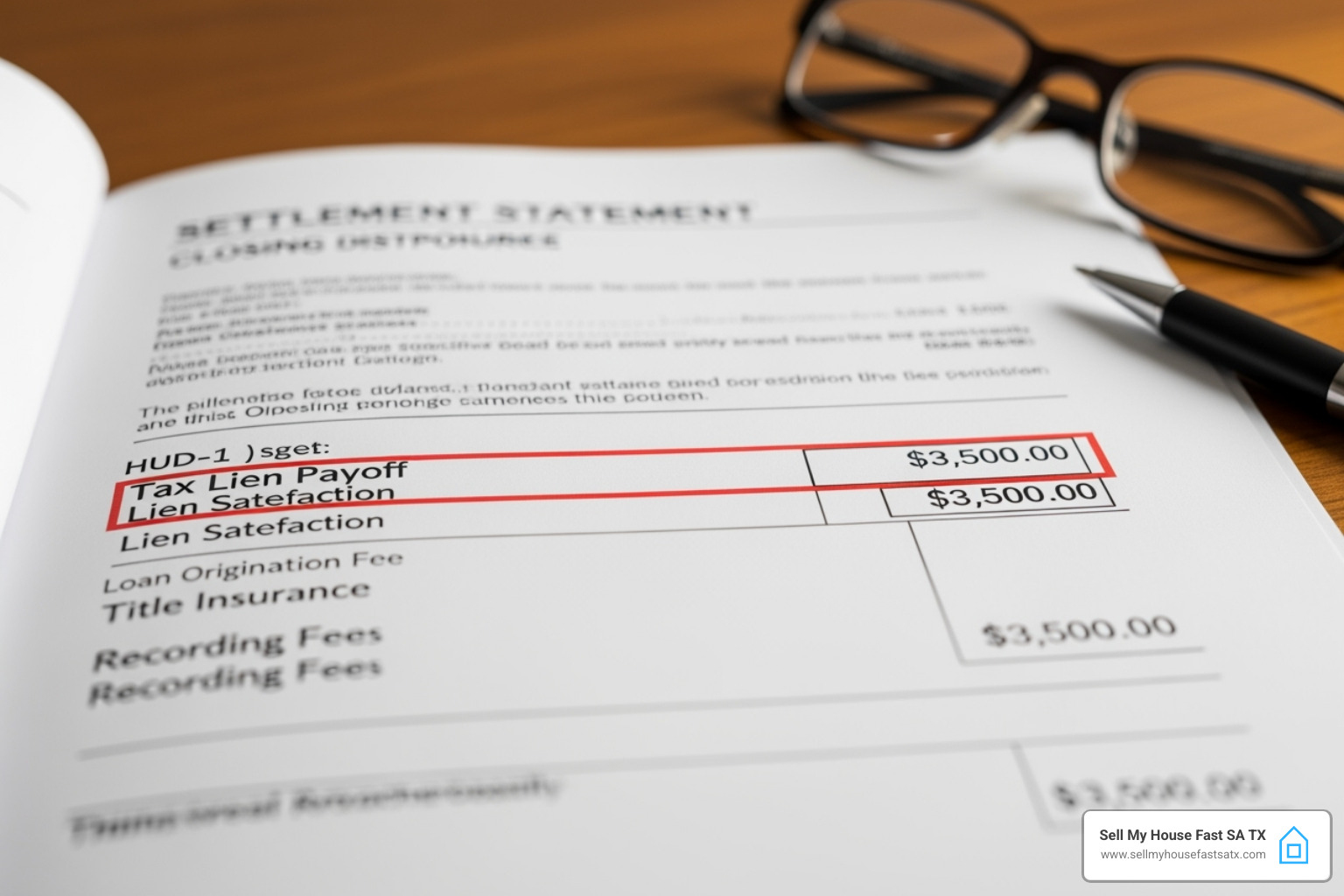

2. Pay the Lien at Closing from Sale Proceeds

This is by far the most common method San Antonio homeowners use when selling a house with a tax lien. Here’s how it works: you find a buyer and agree on a sale price. The title company conducting your closing identifies the tax lien during their title search and contacts the taxing authority to get an official payoff amount.

At the closing table, the lien amount gets deducted directly from your sale proceeds. The title company then sends this money straight to the taxing authority, satisfying the lien and ensuring your buyer receives a clear title. It’s that simple – assuming you have sufficient home equity to cover both the lien and your other closing costs.

The main catch here is timing. Getting a payoff letter from the IRS or other taxing authorities can take up to 30 days, which might delay your closing slightly. But for most homeowners with equity in their property, this method works beautifully because the title company handles all the complexity for you.

3. Negotiate a Settlement with the Taxing Authority

Sometimes you can negotiate with the taxing authority to accept less than the full amount owed. For federal tax liens, this often involves submitting an Offer in Compromise (OIC) to the IRS, where you demonstrate that you cannot pay the full amount or there’s legitimate doubt about what you actually owe.

Bexar County and other local authorities sometimes offer similar negotiation opportunities. The appeal is obvious – if successful, you could significantly reduce the amount you owe, making it much easier to sell your home and clear the lien.

However, I need to be honest with you: this is a long and complex process with no guarantee of success. It often requires hiring a tax professional or attorney to steer the intricacies, and the whole process can take many months. If you need to sell quickly, this probably isn’t your best option.

4. Request a Partial Lien Discharge

A partial lien discharge is a specialized tool that removes the lien from your house only while leaving your personal tax debt intact. This works when you’re selling a property but the tax lien amount is so large that your sale proceeds won’t cover the entire debt.

The IRS may grant this discharge if they determine your property’s value is less than the total tax liability, and you agree to use the sale proceeds to partially satisfy the lien. It’s particularly useful when you have no equity or insufficient equity to cover the full lien amount.

The downside? You still owe the remaining tax debt personally, and the process involves substantial IRS paperwork (like Form 14135) with potentially long processing times. It’s a viable option, but not exactly a quick fix.

5. Use an Installment Agreement as an Alternative

Setting up a payment plan with the taxing authority doesn’t directly help you sell, but it can be a crucial step toward resolving your tax lien situation. If you owe less than $25,000 to the IRS, you can actually request a lien withdrawal after making just three monthly payments on an installment agreement.

This approach demonstrates good faith effort to resolve your debt and can help you avoid foreclosure in San Antonio by showing you’re actively addressing the problem. However, it’s a slow process, and the lien remains on your property until the debt is fully paid or withdrawn. If you need to sell immediately, this won’t solve your urgent situation.

6. Attempt a Short Sale (If You Have No Equity)

When your home’s value is less than what you owe on your mortgage plus the tax lien, a short sale might be your only traditional option. This requires getting both your mortgage lender and the tax authority to agree to accept less than they’re owed from the sale proceeds.

Short sales can help you avoid foreclosure and resolve an impossible financial situation when you’re completely underwater. But they require approval from all creditors, which makes the process time-consuming and complicated. Plus, a short sale will negatively impact your credit score. It’s often a complex last resort before homeowners consider how to sell your house before foreclosure.

7. Sell Your House As-Is to a Direct Cash Buyer

For most San Antonio homeowners asking “can I sell my house with a tax lien,” selling to a direct cash buyer like Sell My House Fast SA TX is the fastest and simplest solution. Here’s why this approach works so well:

When you sell to us, we factor the tax lien into our cash offer and handle the entire payoff process at closing. You don’t have to steer the complexities of lien resolution yourself – we take care of everything. We can often close in as little as one week, and you save on commissions and closing costs entirely.

The beauty of this approach is its certainty and speed. While our cash offer accounts for the lien and any needed repairs, you get the peace of mind of a guaranteed closing without months of uncertainty. This is exactly how you sell your house as-is for a truly stress-free experience.

As direct buyers with over 16 years of experience in San Antonio, you’re dealing directly with us, which ensures a smoother, more reliable transaction when you need it most.

Ready to get started? Get your no-obligation cash offer for your San Antonio house with a tax lien today and let us handle all the complexity for you.

The Consequences of Ignoring a Tax Lien

Here’s the hard truth about tax liens: ignoring them is like ignoring a ticking time bomb. The longer you wait, the worse things get, and the urgency to act is very real.

Every single day you don’t address a tax lien, your debt continues to grow. Penalties and interest keep piling on, turning what might have been a manageable amount into something that feels impossible to tackle. I’ve seen San Antonio homeowners watch their $5,000 tax debt balloon to $15,000 or more simply because they put their heads in the sand and hoped it would go away.

But growing debt is just the beginning. Taxing authorities have some serious collection tools at their disposal, and they’re not afraid to use them. The IRS can escalate from a lien (which is just a claim on your property) to a tax levy, where they actually start seizing your assets. This could mean waking up to find your bank accounts frozen, your paycheck garnished, or your personal property seized.

Now, the IRS generally won’t seize your primary residence unless you owe an enormous amount or there are extraordinary circumstances. But “generally won’t” isn’t the same as “never will” – and do you really want to find out where that line is drawn?

On the local level here in San Antonio, Bexar County takes unpaid property taxes very seriously. If you continue to ignore property tax liens, the county can initiate a tax foreclosure process. This means they can legally seize your home and sell it at auction to recover what you owe them.

Here’s what makes Texas particularly tough: there’s no statute of limitations on collecting unpaid property taxes. The tax collector can pursue you indefinitely. Even more concerning, the foreclosure process can move surprisingly fast – sometimes completed in as little as 60 days if taxes remain completely unpaid.

Don’t let it reach this point. Even if you feel completely overwhelmed right now, taking action today is crucial to protecting your home and your financial future. If foreclosure is already looming, we can help you understand How to Stop Foreclosure in TX and explore your options.

The good news? You still have choices, and selling your house is absolutely one of them. Every day you wait, those choices become fewer and more expensive.

Frequently Asked Questions About Selling a House with a Tax Lien

When facing a tax lien on your San Antonio home, it’s completely natural to have questions. After helping hundreds of homeowners steer this exact situation over my 16+ years in real estate, I’ve heard just about every concern imaginable. Let me address the most common questions I get about can I sell my house with a tax lien situations.

How long does it take to sell a home with a tax lien in Texas?

The timeline really depends on which path you choose, and honestly, this is where most homeowners get frustrated with traditional selling methods. Going the conventional route often means significant delays on top of an already slow market.

The lien-related paperwork alone can add 30-90+ days to your timeline. Getting payoff letters from the IRS can take 30 days or more, and that’s assuming everything goes smoothly. Coordinating between multiple parties—like title companies, taxing authorities, and potential buyers—creates opportunities for delays. In today’s cooling San Antonio market, buyers are getting pickier and taking longer to make decisions.

But here’s the thing – when you sell directly to us at Sell My House Fast SA TX, we handle all the lien complexity behind the scenes. We can close in as little as one week because we’re experienced with these situations and have the systems in place to move quickly. We factor the lien into our cash offer upfront, so there are no surprises or lengthy negotiations.

What happens if the sale proceeds don’t cover the tax lien?

This is honestly one of the scariest questions homeowners ask me, and I completely understand why. When you owe more than your house is worth, it feels like you’re trapped with no way out.

The reality is you still have options, though they can be complex to steer alone. You might qualify for a partial discharge where the taxing authority releases the lien from your property even though you still owe money personally. Or you could pursue an Offer in Compromise to negotiate a lower payoff amount, though this process is lengthy and has no guarantee of success.

What many homeowners don’t realize is that a direct cash buyer can often still purchase your property even in these challenging situations. We’ve successfully helped San Antonio homeowners who owed more in liens than their house was worth. Our experience with these complex scenarios means we can often find creative solutions that work for everyone involved.

What is the best strategy if I need to sell my house fast with a tax lien?

If you need to move quickly and want the least stressful experience possible, selling directly to a reputable San Antonio cash buyer is hands down your best option. I’ve seen too many homeowners try to steer this maze alone, only to get overwhelmed by the bureaucracy and delays.

When you work with Sell My House Fast SA TX, we become your advocate in dealing with the taxing authorities. We handle all the coordination, paperwork, and payoff logistics. You get a same-day cash offer that accounts for the lien, and we cover all title-related closing costs. There are no commissions eating into your proceeds, and you don’t have to worry about repairs or even cleaning the house.

Most importantly, you get certainty. When we make you an offer, that’s exactly what you’ll receive at closing. No last-minute surprises, no deals falling through because of lien complications, no months of uncertainty while your tax debt continues growing.

The peace of mind alone is worth it. Instead of juggling multiple moving parts and hoping everything aligns perfectly, you make one decision and we handle the rest. Get your no-obligation cash offer for your San Antonio house with a tax lien today and see how simple this process can actually be.

Take Control and Sell Your San Antonio House on Your Terms

Can I sell my house with a tax lien? The answer is absolutely yes, and now you know exactly how to make it happen. While dealing with a tax lien can feel overwhelming, selling your house is actually one of the smartest ways to resolve your tax debt and regain your financial freedom.

Throughout this guide, we’ve explored seven different approaches to handling a tax lien when selling your property. From paying the lien at closing to negotiating settlements with taxing authorities, each method has its place. But here’s what I’ve learned after 16+ years in the San Antonio real estate market: the complexity and uncertainty of traditional methods often create more stress than relief for homeowners already dealing with tax problems.

Think about it – do you really want to spend months navigating IRS paperwork, waiting 30+ days for payoff letters, or hoping a settlement negotiation works out? When you’re facing tax debt, time isn’t on your side. Every day that passes means more penalties and interest accruing on your debt.

That’s exactly why we founded Sell My House Fast SA TX. We believe every San Antonio homeowner deserves a simple, straightforward path to selling their home, especially when facing challenging circumstances like a tax lien. Our expertise in construction, finance, and portfolio management, combined with our deep knowledge of the local market, means we can handle what others find complicated.

When you work with us, you’re not just getting a cash offer – you’re getting a stress-free solution. We handle all the lien paperwork, coordinate directly with the taxing authorities, and ensure everything gets paid off properly at closing. No waiting, no uncertainty, no surprises. You save on commissions and closing costs while getting the peace of mind that comes from working with experienced professionals who’ve successfully closed hundreds of transactions just like yours.

We buy houses throughout San Antonio, New Braunfels, Boerne, and Helotes, regardless of their condition or the complexity of the tax situation. Whether you’re dealing with Bexar County property taxes, state liens, or federal IRS liens, we’ve seen it all and handled it successfully.

Don’t let a tax lien hold your future hostage any longer. Take control of your situation today and find how simple selling your house can actually be.

Get your no-obligation cash offer for your house with a tax lien today!