Understanding Capital Gains Tax When Selling Your San Antonio Home

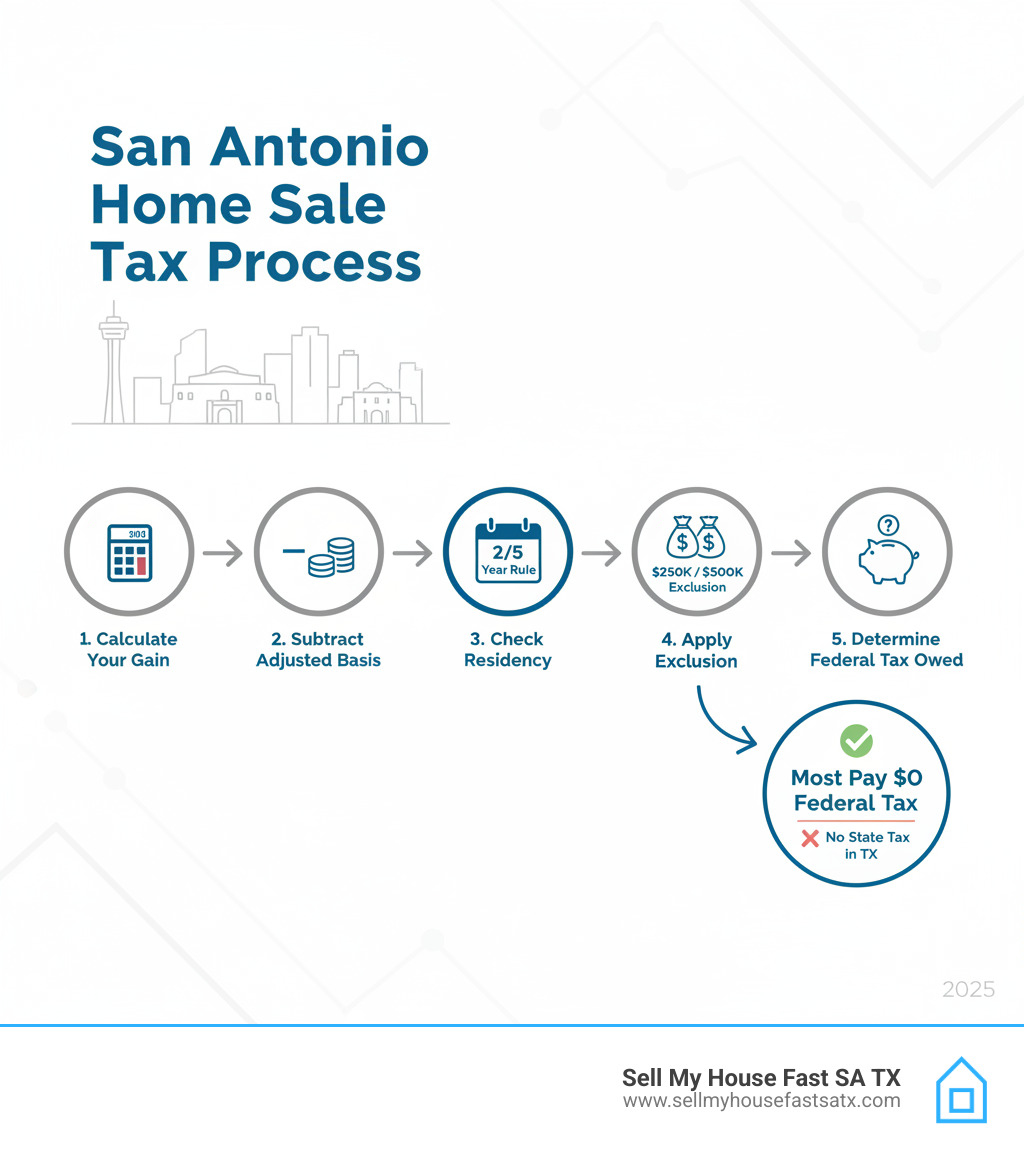

Do you pay taxes when you sell a house? The short answer is that it depends on your profit and how long you lived there. Here’s what San Antonio homeowners need to know:

- Most homeowners pay $0 in federal taxes thanks to the primary residence exclusion.

- Single filers can exclude up to $250,000 in profit.

- Married couples filing jointly can exclude up to $500,000 in profit.

- You must have owned and lived in the home for at least 2 of the last 5 years to qualify.

- Texas has no state capital gains tax, so only federal rules apply.

- If your profit exceeds these limits, you’ll pay capital gains tax on the excess amount.

Selling your home can be overwhelming, but the tax implications are often less scary than they seem. Most San Antonio homeowners selling their primary residence won’t owe any federal taxes, and there’s never a state tax in Texas.

I’m Daniel Cabrera, founder of Sell My House Fast SA TX. With over 16 years in real estate, I’ve helped hundreds of homeowners steer the question do you pay taxes when you sell a house while providing fast, fair cash offers. Understanding these rules helps my clients keep more money in their pockets during a stressful time.

The Basics of Capital Gains Tax on Home Sales

When you sell a home in San Antonio, TX, you might wonder, “Do you pay taxes when you sell a house?” This is where federal capital gains tax comes in, but it’s not as scary as it sounds.

What is capital gains tax?

Capital gains tax is a tax on the profit you make from selling your home, not the entire sale price. For example, if you bought your San Antonio home for $200,000 and sold it for $300,000, your profit (or “gain”) is $100,000. This is the only amount that could be taxed. Fortunately, most homeowners pay zero tax due to generous exclusions we’ll cover next. The IRS provides detailed information on capital gains tax rates if you want to dig deeper.

What’s the difference between short-term and long-term capital gains?

The IRS treats gains differently based on how long you owned the home.

- Short-term capital gains: If you owned the home for less than one year, the profit is taxed at your regular income tax rate (10% to 37%).

- Long-term capital gains: If you owned the property for more than one year, your profit is taxed at lower rates of 0%, 15%, or 20%, depending on your income. Holding your San Antonio home for over a year can lead to significant tax savings.

How does this apply to selling a home in San Antonio, TX?

Here’s the best news for Texas homeowners: Texas has no state capital gains tax. Unlike sellers in other states, San Antonio homeowners only need to consider federal rules. This is a huge advantage that helps you keep more of your equity. At Sell My House Fast SA TX, we always highlight this benefit to our clients. It’s one less thing to worry about, meaning more money stays in your pocket. This guide focuses exclusively on federal rules, which can help you save thousands when you sell your San Antonio home.

The Home Sale Tax Exclusion: Your Key to a Tax-Free Profit

While capital gains tax sounds daunting, the federal government offers a generous exclusion for the sale of your main home. This is why most homeowners we work with at Sell My House Fast SA TX pay little to no tax on their sale.

Primary residence exclusion (Section 121)

The IRS’s Section 121 exclusion allows you to exclude a large portion of your home sale profit from taxes. Single filers can exclude up to $250,000 of profit, and married couples filing jointly can exclude up to $500,000. If your profit is below these limits, you likely owe no federal capital gains tax. For example, a couple I worked with in Boerne had a $340,000 profit that was completely tax-free because it was under their $500,000 exclusion. You can find more details directly from the IRS on Section 121.

The “2-out-of-5-Year” Rule

To qualify for this exclusion, you must pass two tests within the five-year period ending on the sale date:

- The Ownership Test: You must have owned the home for at least two years (24 months).

- The Use Test: You must have lived in the home as your main residence for at least two years (24 months).

These two years don’t have to be continuous. For example, living in your San Antonio home for 18 months, renting it out, and then moving back for another 6 months would meet the 2-year use test. Meeting both tests is the key to open uping the exclusion. The IRS provides clear guidelines, and we recommend reviewing official sources like the IRS rules on the exclusion.

The Look-Back Test

One final condition is the “look-back test.” You can only claim the home sale exclusion once every two years. This rule prevents homeowners from repeatedly flipping houses tax-free. For example, if you sold a home in New Braunfels and used the exclusion 18 months ago, you must wait another six months before you can use it again on a San Antonio home sale. Planning your sales around this two-year window is crucial for maximizing your tax benefits.

Do You Pay Taxes When You Sell a House? Calculating Your Gain

To see if your profit falls within the tax-free limits, you need to calculate your gain. The formula is simple:

Selling Price – Adjusted Basis = Gain/Loss

Your “adjusted basis” is your total investment in the property, and calculating it correctly can significantly reduce your potential tax bill.

How to determine your home’s adjusted basis

Your adjusted basis is more than just the purchase price. Here’s how to calculate it:

- Start with your original purchase price.

- Add certain buying costs like title insurance and legal fees.

- Add the cost of capital improvements—major projects that add value, like a new roof or kitchen remodel. Regular maintenance doesn’t count. See our guide on Home Improvements to Increase Value.

- Subtract any depreciation you claimed if you used part of your home for business or as a rental.

Your gain is also reduced by your selling expenses, such as commissions and other closing costs. Learn more about What Are Closing Costs in San Antonio?. For complete details, review the IRS guidance on basis.

So, do you have to pay taxes when you sell a house in San Antonio?

Let’s walk through an example. You bought a house for $250,000 and spent $50,000 on improvements, making your adjusted basis $300,000. You sell for $500,000 and have $30,000 in selling expenses. Your amount realized is $470,000 ($500,000 – $30,000).

Your gain is $170,000 ($470,000 – $300,000). Since this is below the $250,000 (single) or $500,000 (married) exclusion, you would pay no federal tax. This is why most San Antonio homeowners pay no tax.

What if you sell for a loss? A loss on the sale of your primary home is a personal loss and is not deductible.

What about special situations like inherited homes?

Tax rules differ for inherited or investment properties.

- Inherited Property: You get a “stepped-up basis,” meaning the home’s cost basis is its fair market value on the date of the previous owner’s death. For example, if a home was worth $400,000 when you inherited it, your basis is $400,000. If you sell it for $410,000, your taxable gain is only $10,000. This often results in little to no tax. We specialize in helping families with inherited houses in San Antonio. Learn more in our article on selling inherited house 2022.

- Second Homes and Investment Properties: These do not qualify for the primary residence exclusion. Any gain is generally subject to capital gains tax and may involve other complex rules like depreciation recapture.

Reporting the Sale and Understanding Exceptions

Even if you don’t owe tax, you may need to report the sale to the IRS. The reporting requirements aren’t as complicated as they sound, and there are helpful exceptions for San Antonio homeowners.

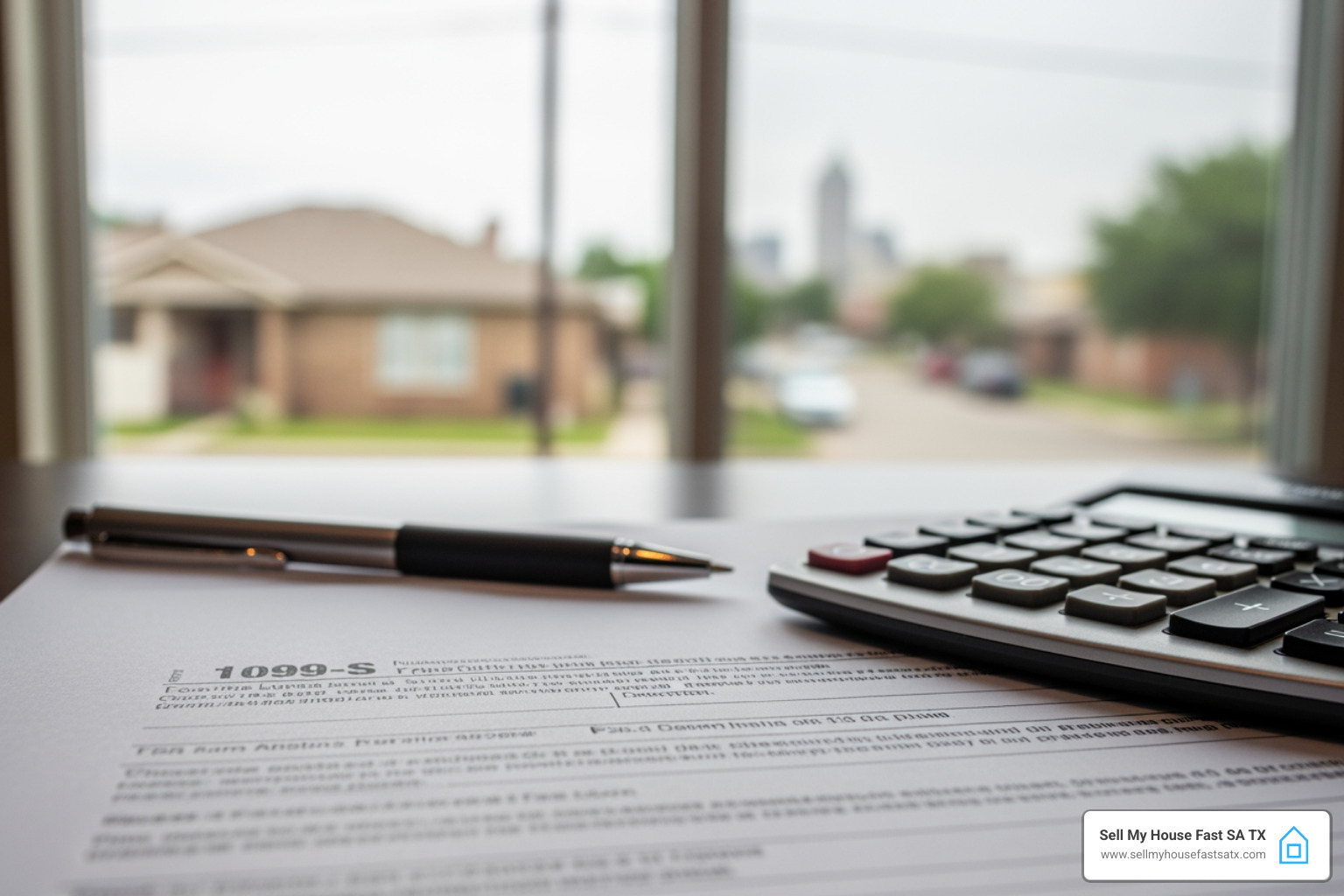

Form 1099-S and Form 8949

At closing, the title company may issue Form 1099-S, which reports the sale proceeds to the IRS. If you receive this form, you generally must report the sale on your tax return. However, if you certify that your entire gain is excludable, the agent may not have to issue the form, saving you paperwork.

If you have a taxable gain (your profit exceeds the exclusion), you’ll report the sale on Form 8949, Sales and Other Dispositions of Capital Assets. We are real estate professionals, not tax advisors, and always recommend consulting a CPA for personalized advice.

Are there exceptions to the 2-year rule?

If you must sell your San Antonio home before meeting the 2-year ownership and use requirements, you may qualify for a partial exclusion. The IRS allows this for certain “special circumstances,” letting you exclude a prorated amount of the gain.

Qualifying reasons include:

- Job Relocation: Your new job is at least 50 miles farther from the home than your old job.

- Health Reasons: Moving to receive medical care or to care for a sick family member.

- Unforeseen Circumstances: Events like divorce, death of a spouse, or natural disasters.

Special rules for military members in the San Antonio area allow service members on qualified extended duty to suspend the five-year test period for up to ten years. This is a huge help for military families facing frequent relocations. A partial exclusion can significantly reduce your tax burden. For full details, see IRS Publication 523: Selling Your Home.

At Sell My House Fast SA TX, we help homeowners in these exact situations. We provide a fast, fair cash offer that lets you move forward quickly, no matter how long you’ve owned your home.

Frequently Asked Questions About Home Sale Taxes

Here are answers to common questions we hear from homeowners in San Antonio, Boerne, and Helotes.

What if I sell my house for a loss in Texas?

A loss on the sale of your primary residence is considered a personal loss by the IRS and is not tax-deductible.

Are my closing costs from the sale tax-deductible?

Closing costs aren’t directly deductible. However, selling expenses like real estate commissions and legal fees are subtracted from your sales price. This reduces your total capital gain, which lowers your potential tax bill.

How do you pay taxes when you sell a house you inherited?

Inherited homes get a “stepped-up basis,” meaning your cost basis is the home’s fair market value at the time of the owner’s death. If you inherit a San Antonio home valued at $350,000 and sell it for $360,000, your taxable gain is only $10,000. Since inherited property is always treated as long-term, this gain is taxed at lower rates. Selling soon after inheritance often results in little to no tax. For more, see our guide on Selling Inherited House 2022.

The Easiest Way to Handle Your San Antonio Home Sale

We’ve covered the key tax rules for selling a house in San Antonio, TX. While it can seem complex, the good news is most homeowners pay no federal capital gains tax on their primary home, and Texas has no state capital gains tax. But even without a tax burden, selling a house is stressful. That’s where we come in.

At Sell My House Fast SA TX, we offer a simple, stress-free solution that cuts through the hassle:

- No commissions: We buy directly from you, saving you thousands.

- No closing costs: We cover all standard closing costs.

- No repairs or cleaning needed: We buy houses in San Antonio, Boerne, and Helotes “as-is.” No problem is too big.

- Flexible closing date: We can close in as little as one week or work on your schedule.

- Fair, all-cash offer: Get an offer from a trusted local company with 16+ years of experience.

- We are direct cash buyers: This is crucial. We use our own funds to buy your house, ensuring a reliable sale without middlemen or delays.

Here’s what one of our San Antonio homeowners, Jennifer R., had to say: “My San Antonio home needed major foundation repairs and felt impossible to sell. Daniel and the team at Sell My House Fast SA TX bought it quickly and handled everything!”

We’re proud of our 5-star Google reviews and A+ rating with the Better Business Bureau. We are committed to being the most helpful cash home buyers in San Antonio.

Ready to skip the tax headaches and sell your San Antonio house fast? Take control of your home sale with a trusted local cash buyer.

✅ Request your no-obligation cash offer for your San Antonio house!