Your Final Payday After Selling Your House in San Antonio, TX

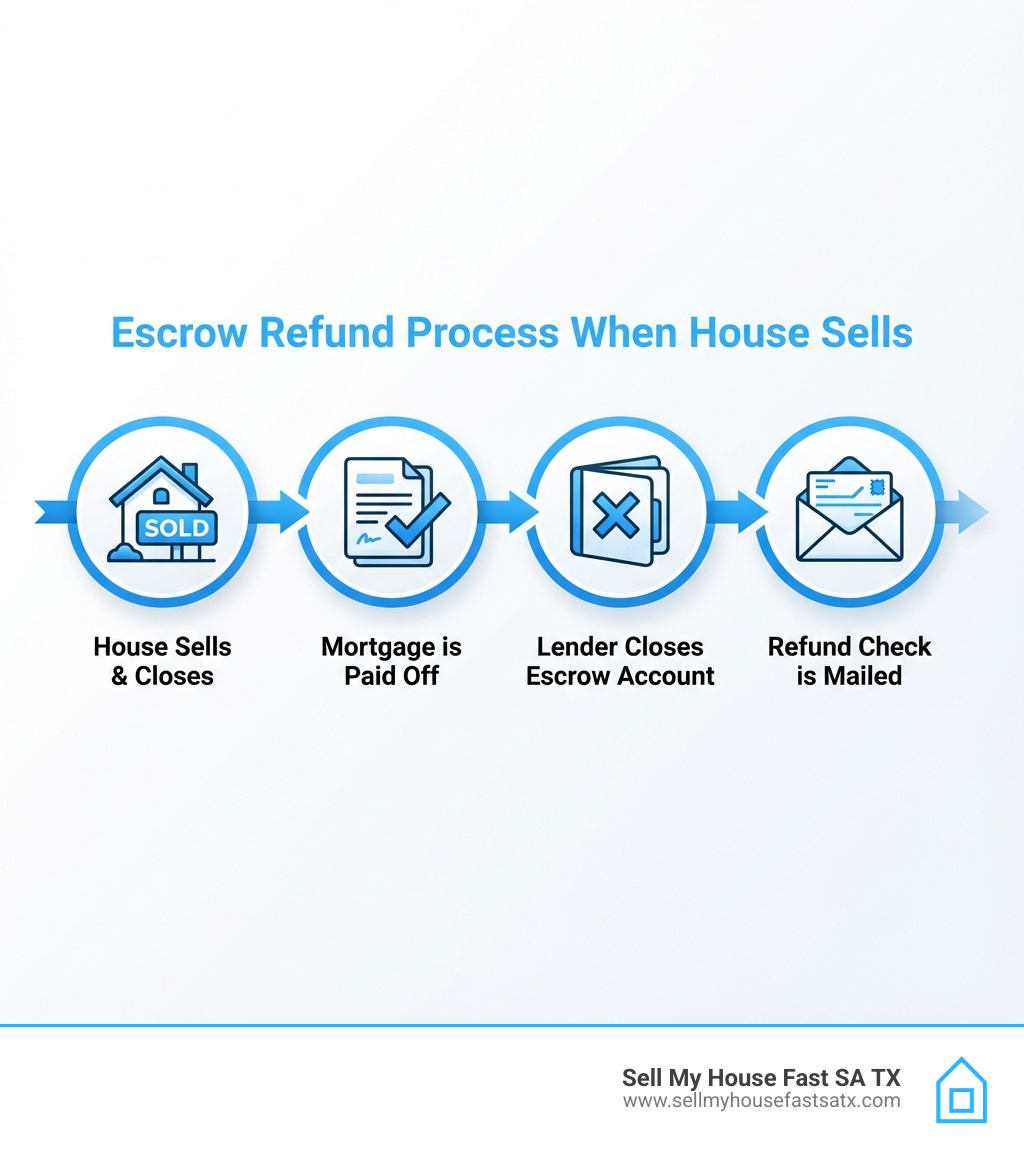

How will I receive my escrow refund when house sells? Most mortgage servicers in Texas will mail you a physical check within 20 business days after your loan is paid off at closing. Here’s what to expect:

- Your house sells and closes – The sale proceeds pay off your mortgage in full

- Your lender closes your escrow account – This happens automatically after receiving the payoff

- Refund is processed – Your servicer calculates the remaining balance in your escrow account

- Check is mailed – You receive a physical check at your last address on file (typically within 20-30 days)

Selling your house in San Antonio, TX is a major financial milestone, but your transaction isn’t truly complete until you receive your escrow refund. Many homeowners are pleasantly surprised to find they’re owed money after closing—sometimes hundreds or even thousands of dollars that were set aside for property taxes and homeowners insurance. This guide explains exactly what triggers an escrow refund, the typical timeline for receiving it, and how to make sure you get your money quickly and without hassle.

With the San Antonio market cooling, it’s more important than ever to maximize every dollar from your sale—starting with your escrow refund. Understanding this process can help you avoid common delays and ensure your final payday arrives on time.

I’m Daniel Cabrera, founder of Sell My House Fast SA TX, and over my 16+ years in San Antonio real estate, I’ve helped hundreds of homeowners steer the closing process and understand exactly how will I receive my escrow refund when house sells. I’ve seen how confusing this final step can be, and I’m here to break it down in simple terms.

What is an Escrow Refund and Why Do You Get One?

When you bought your home here in San Antonio, you likely heard the term “escrow account” during the mortgage process. For many, it’s a bit of a mystery, but it plays a crucial role in managing your homeownership expenses. And when you sell, it becomes the source of a pleasant surprise: an escrow refund.

Understanding Your Mortgage Escrow Account in Texas

Simply put, an escrow account is a special fund managed by your mortgage lender. Its purpose is to collect and hold money specifically for your property taxes and homeowner’s insurance premiums. Instead of you having to save up large sums to pay these bills annually or semi-annually, your lender collects a portion with each monthly mortgage payment. This way, when those big bills come due, the money is already there, ready to be paid.

For example, if your yearly property taxes in San Antonio are $3,000 and your homeowner’s insurance is $1,200, that’s a total of $4,200 annually. Your lender would divide that by 12, adding $350 to your monthly mortgage payment for escrow. This ensures these important bills are always covered, preventing lapses in insurance or late property tax payments, which could lead to penalties or even foreclosure. It’s a convenient system designed to simplify your financial responsibilities as a homeowner.

What Triggers an Escrow Refund When You Sell?

The magic of an escrow refund happens when you sell your San Antonio house. When the sale closes, a significant part of the proceeds goes directly to paying off your existing mortgage in full. Once your lender receives this final payment, your mortgage loan is officially “paid off.”

At this point, your mortgage servicer no longer needs to manage an escrow account for a loan that no longer exists. They will then close your escrow account. Any money that was left in that account after all outstanding property taxes and homeowner’s insurance premiums have been paid up to the closing date is considered a surplus. This surplus is your money, and your lender is legally obligated to return it to you. The Real Estate Settlement Procedures Act (RESPA) requires lenders to return any remaining balance in an escrow account after a loan is paid in full. So, in essence, your escrow refund is simply your own funds coming back to you after they’ve served their purpose.

How Will I Receive My Escrow Refund When House Sells? Timeline and Process

After the excitement of selling your house in San Antonio and navigating the closing table, many sellers find themselves wondering, “Okay, the house is sold, but how will I receive my escrow refund when house sells?” This is a very common and important question, as that refund can be a welcome boost to your post-sale finances.

How Long Does It Take to Get the Refund?

The good news is that there are clear guidelines for how quickly you should receive your money. According to Consumer Financial Protection Bureau (CFPB) guidelines, most mortgage servicers are required to mail escrow refund checks within 20 calendar days after your loan payoff. While some sources mention up to 30 business days, you can generally expect to receive your refund within three to four weeks after your mortgage has been paid in full at closing.

Here’s a typical breakdown of the timeline you can expect:

- Loan Payoff Processing (0-5 days): After closing, the title company sends the payoff amount to your mortgage servicer. It takes a few days for them to process this and officially mark your loan as “paid in full.”

- Servicer Closes Escrow (5-15 days): Once the loan is paid off, your servicer will conduct a final review of your escrow account. They’ll ensure all pending tax and insurance payments up to the closing date have been made or accounted for.

- Refund Issuance (20-30 days): After closing the account, your servicer will issue the refund. For us here in Texas, servicers generally issue escrow refund checks within 20 calendar days after a mortgage is paid off. So, if you’ve recently sold your home in San Antonio, you should be circling those 20-30 days on your calendar!

This process only begins after your loan is fully paid off at closing. So, while you might be eager for those funds, patience for a few weeks post-closing is key.

How Will I Receive My Escrow Refund? (Check vs. Direct Deposit)

When it comes to the actual method of receiving your refund, there are a couple of possibilities, though one is far more common.

- The Most Common Method: A Mailed Check. For the vast majority of homeowners in San Antonio, your escrow refund will arrive as a physical check mailed to the last address your mortgage lender has on file for you. This is a standard practice across the industry. This is why it’s absolutely crucial to ensure your forwarding address is up-to-date with your lender well before closing. If your address is incorrect, your check could be delayed or even sent to the wrong place, creating unnecessary headaches.

- Direct Deposit (Less Common, but Possible): While not as universally offered as mailed checks, some forward-thinking lenders may provide the option for a direct deposit into your bank account. This can significantly cut down on the waiting time. For example, in Texas, direct deposit refunds can sometimes reduce wait times from 20 days to just 5-7 business days. If your servicer offers this, it’s definitely worth pursuing for a quicker turnaround. However, you’ll almost certainly need to proactively request this option and provide your banking details. Don’t assume it will happen automatically.

To ensure a smooth refund process, we always recommend confirming with your mortgage servicer what their standard refund method is and verifying your mailing address or inquiring about direct deposit options.

Common Reasons for Delays and How to Avoid Them

We all love getting money back, especially when it’s unexpected. So, when your escrow refund is due after selling your San Antonio home, the last thing you want is a delay. While the process is generally straightforward, a few common issues can slow things down.

Top Reasons Your Escrow Refund Might Be Delayed

Understanding these potential roadblocks can help you be proactive and avoid them:

- Incorrect or Outdated Mailing Address: This is perhaps the most frequent culprit for delays. If your mortgage servicer doesn’t have your current address, your refund check could end up in the wrong mailbox or be returned to sender. They often mail the check to the address associated with the property you just sold, unless you’ve updated it.

- Internal Processing Delays at the Lender: Sometimes, despite everyone’s best efforts, things move slowly within large organizations. A backlog of payoffs, staffing issues, or a complicated final escrow analysis can all contribute to internal delays.

- Issues with the Closing Statement: Although less common, discrepancies or errors on the final closing disclosure (also known as the settlement statement) could hold up the process. If there’s any confusion about the final figures, your servicer might pause the refund until clarity is achieved.

- Delinquent Payments at the Time of Sale: If you were behind on your mortgage payments leading up to the sale, or if there were any outstanding charges or fees, your servicer might deduct these from your escrow balance before issuing a refund. While this is standard practice, it can sometimes require additional processing time. Also, if you were more than 30 days late on payments, lenders can sometimes retain escrow funds.

- Missing Information: While typically not required, sometimes a servicer might need a specific piece of information from you to finalize the refund, especially if offering direct deposit. If you don’t provide it promptly, it will cause a delay.

How to Avoid Delays

We want you to receive your hard-earned refund as swiftly as possible. Here are some actionable steps you can take to minimize the chances of a delay:

- Double-Check Your Forwarding Address with Your Lender Before Closing: This is paramount. A week or two before your closing date, contact your mortgage servicer directly. Confirm the address they have on file for mailing your refund check. If you’ve moved, provide your new mailing address immediately. Don’t rely solely on the post office’s mail forwarding service for such an important document.

- Keep Records of Your Closing Date and Payoff Statement: Having these documents handy will be invaluable if you need to follow up. Your payoff statement confirms your loan was paid in full, and your closing date is the start of the refund timeline.

- If You Haven’t Received Your Refund After 30 Business Days, Contact Your Lender’s Customer Service: Don’t wait indefinitely. If the 30-day mark passes and your refund hasn’t arrived, pick up the phone. Have your loan number and closing date ready. Politely inquire about the status of your escrow refund. They can often tell you if a check has been issued, when it was mailed, or if there’s any issue holding it up.

- Consider Electronic Refund Options: As mentioned earlier, if your servicer offers direct deposit for refunds, inquire about it. This can often be faster and more secure than waiting for a mailed check.

- Review Your Final Closing Disclosure: Before you leave the closing table, take a moment to understand the figures related to your escrow account payoff. Your title company or closing agent in San Antonio should be able to explain how the escrow balance was calculated and what to expect.

By taking these proactive steps, you can significantly increase the likelihood that you’ll receive your escrow refund promptly after selling your San Antonio home.

Frequently Asked Questions about Escrow Refunds in San Antonio, TX

We know that selling a house brings up a lot of questions, and the escrow refund is often one of the last ones on people’s minds, but it’s certainly not the least important! Here are some common questions we hear from San Antonio homeowners about their escrow refunds.

What happens to my escrow account when my mortgage is paid off?

Once your mortgage loan is fully paid off through the proceeds of your home sale, your mortgage servicer will close your escrow account. The funds held in that account were specifically for paying your property taxes and homeowner’s insurance while you had an active mortgage with them. Since the mortgage is gone, the need for the escrow account vanishes too. After all final payments for taxes and insurance up to your closing date are made, any remaining balance in the account is calculated and prepared for refund to you. So, in short, it gets shut down, and the leftover money is returned to you.

Do I have to pay taxes on my escrow refund?

This is a fantastic question, and we’re happy to say, no, you do not have to pay taxes on your escrow refund! This is because the money you receive is not considered taxable income. Think of it this way: the funds in your escrow account were money you already paid to your mortgage lender. It’s essentially a refund of your own overpayment for expenses like property taxes and insurance. Since you already paid those funds, getting them back isn’t new income, it’s just a return of principal. You won’t receive a tax form for this refund, and you don’t need to report it to the IRS.

How is the escrow refund amount determined?

The amount of your escrow refund is determined by a final analysis conducted by your mortgage servicer. They look at the total amount you’ve paid into the escrow account versus the total amount they’ve disbursed for your property taxes and homeowner’s insurance up to the date your mortgage was paid off.

Here’s what impacts the amount:

- Your monthly contributions: How much you’ve been paying into escrow each month.

- Timing of payments: When your lender last made a property tax or insurance payment. For instance, if your lender just paid your annual property taxes a month before you closed, the remaining balance in your escrow account might be significantly smaller, as a large chunk of the funds would have just been used.

- Changes in expenses: If your property taxes or insurance premiums decreased over the last year, you might have a larger surplus. Conversely, an increase might mean a smaller refund or even a small deficit that was covered by the sale proceeds.

Your servicer will perform this final calculation and refund any surplus of $50 or more. If the surplus is less than $50, some lenders might choose to apply it to any remaining fees or simply not issue a check, though many will still refund smaller amounts.

What areas does Sell My House Fast SA TX serve?

While our primary focus is helping homeowners right here in San Antonio, we also serve many of the surrounding communities, including San Marcos. Our local expertise is what allows us to provide the best service and a fair cash offer tailored to the area. If you’re in the greater San Antonio region and need a quick, hassle-free home sale, we encourage you to reach out. If you’re unsure whether your property is within our service area, please contact us—we’re always happy to help.

The Fastest Way to Get Your Escrow Refund in San Antonio, TX

The process of receiving your escrow refund only truly kicks off once your mortgage is paid off. This means that the faster you sell your house and close the deal, the sooner you’ll see that refund check in your hands. If you’re looking to expedite this entire process and get your money—including your escrow refund—as quickly as possible, we believe Sell My House Fast SA TX is your best option in the San Antonio area.

Why Choose Sell My House Fast SA TX?

We understand that selling a house can be a complex and often stressful endeavor, especially in a cooling market. That’s why we’ve built our business around making it as easy and beneficial for you as possible. When you choose to work with us, you’re choosing a streamlined, transparent process designed to put cash in your hands and your escrow refund on its way faster than you might think.

Here’s why San Antonio homeowners trust us:

- 16+ Years of Local Experience in San Antonio Real Estate: Our founder, Daniel Cabrera, has over 16 years of experience right here in the San Antonio real estate market. This deep local knowledge, coupled with expertise in construction, finance, investment banking, loans, and portfolio management, means we understand the market and can offer you a fair, competitive cash price. We’re not just some out-of-town wholesaler; we’re deeply invested in our community.

- No Realtor Commissions or Closing Costs: This is a huge financial advantage. When you sell to us, you save thousands of dollars that would typically go to real estate agent commissions (often 5-6% of the sale price!). Plus, we cover all title-related closing costs, meaning more money stays in your pocket. This directly contrasts with traditional sales where you might pay thousands in fees. For a deeper dive into these savings, check out our guide on What Are Closing Costs in San Antonio?.

- We Buy Houses As-Is—No Repairs, No Cleaning, No Hassle: Forget about costly repairs, staging, or even cleaning. We buy your house exactly as it is. Whether it needs major foundation work, has an outdated kitchen, or simply accumulated years of clutter, we’ll take it. This saves you time, money, and a tremendous amount of stress. Learn more about Selling Your House As-Is in San Antonio.

- Flexible Move-Out Dates and Personalized Service: We work on your timeline. Need a few extra weeks after closing to pack up? No problem. We can arrange a flexible move-out date that fits your schedule. Our personalized service ensures that from your initial cash offer to the final closing, your experience is easy and stress-free. We pride ourselves on being customer-centric.

- Trusted by San Antonio Homeowners—5-Star Reviews on Google and BBB: We’ve built a strong reputation in the San Antonio community for our honesty, integrity, and fair dealings. Our 5-star reviews on Google and an A+ rating with the Better Business Bureau reflect our commitment to providing an exceptional selling experience.

Choosing Sell My House Fast SA TX means choosing convenience, financial savings, and peace of mind. We simplify the entire selling process, from getting your cash offer to the closing table, ensuring your escrow refund is triggered without unnecessary delays.

Testimonial: “My San Antonio home needed major foundation repairs and felt impossible to sell. Daniel and the team at Sell My House Fast SA TX bought it quickly and handled everything!” – Jennifer R., San Antonio homeowner

Ready to Sell and Get Your Escrow Refund Fast?

Understanding how will I receive my escrow refund when house sells is the final piece of your home-selling puzzle. While it’s a small detail in the grand scheme, it’s your money, and you deserve to get it back quickly and efficiently. Don’t let the traditional selling process drag out, delaying your mortgage payoff and, consequently, your escrow refund.

With Sell My House Fast SA TX, we streamline the entire process. We offer a same-day cash offer and can close in as little as one week. This means your mortgage is paid off, your escrow account is closed, and your refund is on its way significantly faster than if you were to list your home on the market with a realtor, endure showings, negotiations, and potentially months of waiting.

We make selling your house in San Antonio straightforward, allowing you to move on to your next chapter with your cash in hand and your escrow refund on its way. Don’t wait months for your money. Sell your house fast, get your mortgage paid off, and receive your escrow refund the right way—with no stress, no fees, and no delays.

✅ Request your no-obligation cash offer for your San Antonio house now!