Sell My House During Bankruptcy in San Antonio, TX

Navigating the financial complexities that arise during bankruptcy proceedings can feel overwhelming. This is especially true when dealing with bankruptcy in San Antonio, TX, where your financial obligations and assets must be carefully managed. Bankruptcy involves restructuring debts and managing assets according to federal bankruptcy laws and court requirements.

One of the most challenging aspects of bankruptcy proceedings is managing real estate assets, particularly if there’s a need to sell your house. This process can be complex, time-consuming, and emotionally demanding, especially when you’re already dealing with financial stress.

Fortunately, there are solutions tailored for homeowners facing this situation. An example is Sell My House Fast SA TX, a company specializing in hassle-free purchases of properties from homeowners going through bankruptcy. Their streamlined sales approach simplifies what can otherwise be a difficult home-selling experience, providing support during this challenging financial period.

In the following sections, we’ll explore what it means to sell my house during bankruptcy in San Antonio, TX. We’ll examine how a reputable home-buying company in San Antonio can facilitate selling your property during bankruptcy proceedings and offer guidance on navigating through this complex process.

Understanding Bankruptcy and Home Sales in San Antonio, Texas

Selling a house during bankruptcy is a legal process that requires court approval and careful navigation of federal bankruptcy laws. It’s crucial to understand this process, especially when managing real estate during financial restructuring.

Bankruptcy serves several functions when it comes to your home:

- Asset Protection: It determines which assets you can keep (exemptions) and which may need to be sold.

- Debt Relief: It provides a mechanism for eliminating or restructuring debts secured by your property.

- Court Oversight: It ensures all transactions are conducted fairly and in compliance with bankruptcy laws.

- Creditor Protection: It establishes an orderly process for addressing claims against your assets.

Can You Sell Your House After Filing Bankruptcy?

The answer depends on several factors, including the type of bankruptcy filed and the timing of your request. When you file for bankruptcy, an automatic stay goes into effect, which generally prevents you from selling assets without court permission.

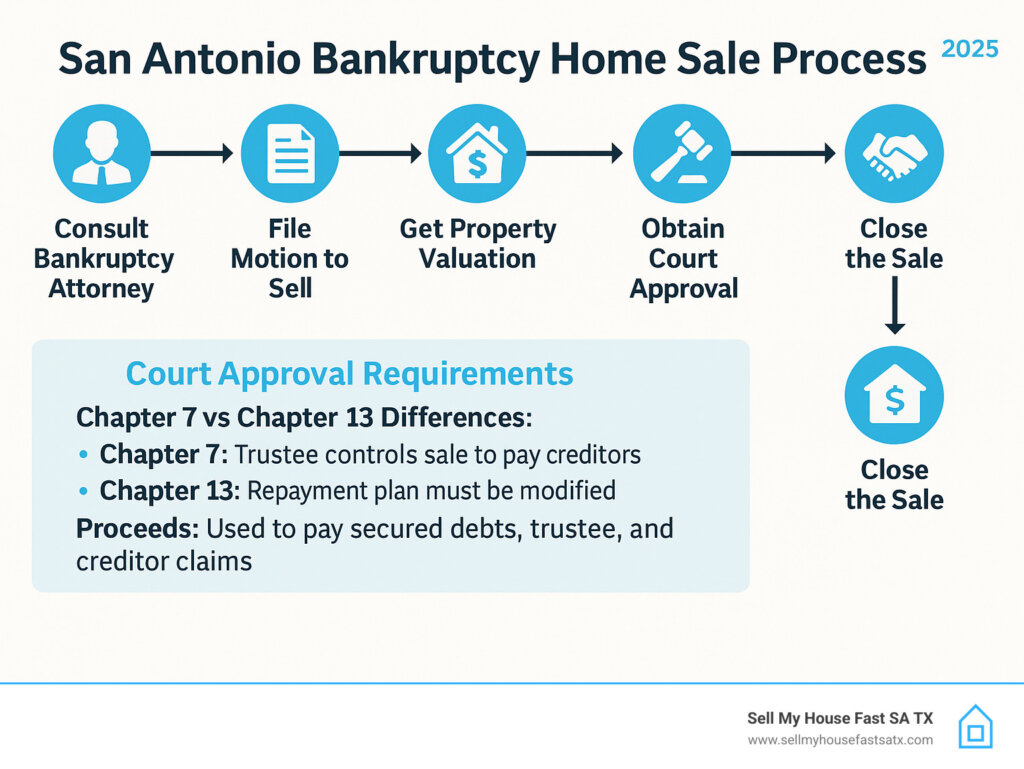

Navigating bankruptcy home sales in San Antonio, Texas involves these steps:

- Filing Motion: A motion to sell real property must be submitted to the bankruptcy court.

- Court Review: The court reviews your financial situation and the proposed sale terms.

- Creditor Notification: Notice is provided to creditors and interested parties.

- Court Hearing: The court holds a hearing to approve or deny the sale request.

- Asset Valuation: The property must be appraised to ensure fair market value.

- Sale Completion: Once approved, the sale proceeds according to court-ordered terms.

The debtor or trustee plays a crucial role in this process, with key responsibilities including:

- Asset Management: Protecting and maintaining the property during bankruptcy proceedings

- Financial Compliance: Ensuring all court orders and bankruptcy requirements are met

- Legal Coordination: Working with attorneys and the court to facilitate the sale process

- Proceeds Distribution: Ensuring sale proceeds are distributed according to bankruptcy law

Understanding these roles provides insight into what to expect when selling a house during bankruptcy in San Antonio, Texas. Proper legal guidance can significantly impact how smoothly this process unfolds.

How Long After Bankruptcy Can I Sell My House?

The timing for selling your house depends on the type of bankruptcy you’ve filed:

Chapter 7 Bankruptcy

In Chapter 7 bankruptcy, if your home isn’t protected by exemptions, the trustee may sell it to pay creditors. However, if you want to sell before the trustee acts, you typically need court approval immediately after filing.

Chapter 13 Bankruptcy

In Chapter 13 bankruptcy, you generally retain ownership of your home while following a repayment plan. You can request court permission to sell during the active bankruptcy case, usually after demonstrating that the sale serves the best interests of creditors and the estate.

Chapter 7 vs. Chapter 13: How They Differ for Home Sales

Chapter 7 vs. Chapter 13: How They Differ for Home Sales

The path to selling your San Antonio home during bankruptcy varies dramatically depending on the chapter you file. While both require court oversight, the control and implications differ.

| Feature | Chapter 7 (Liquidation) | Chapter 13 (Reorganization) |

|---|---|---|

| Control Over Sale | Trustee primarily controls the sale of non-exempt assets. | You, the debtor, generally maintain control of your assets. |

| Goal | Liquidate non-exempt assets to pay creditors; discharge remaining unsecured debts. | Reorganize debts and repay creditors over 3-5 years via a court-approved plan. |

| Home Sale Purpose | To generate funds for creditors from non-exempt equity. | To adjust your repayment plan, pay off debts, or relocate. |

| Trustee’s Role | Actively sells non-exempt property. | Oversees your repayment plan; must approve your motion to sell. |

| Court Approval | Required for the trustee to sell the property. | Required for you to sell the property. |

| Impact on Repayment Plan | Not applicable, as it’s a liquidation. | The plan must be modified to account for the sale proceeds and changed financial situation. |

| Proceeds Use | Non-exempt equity goes to creditors. Secured debts (mortgage) are paid first. | Used to pay off creditors, potentially reducing your plan payments. |

| Timeline | Can be faster if trustee wants to liquidate quickly; depends on court schedule. | Can be slower due to plan modification and motion to sell. |

| Exemptions | Crucial for protecting equity from liquidation. | Helps determine how much equity must be paid back to creditors. |

In Chapter 7, the trustee controls the sale of your home if it has significant non-exempt equity. Thanks to Texas’s generous homestead exemption, many San Antonio homes are protected and don’t need to be sold by the trustee.

In Chapter 13, you control the decision to sell. However, you must file a motion with the court and modify your repayment plan to account for the sale proceeds. This is where Sell My House Fast SA TX is invaluable; as an experienced cash buyer, we understand the court approval process and can structure deals that satisfy all requirements.

Post-Discharge Sales

The question “can I sell my house after bankruptcy discharge” has a clearer answer: Yes, once your bankruptcy is discharged, you typically regain full control over your exempt assets, including your home, and can sell without court approval.

The Process of Selling a House During Bankruptcy in San Antonio, TX

When handling the sale of a property during bankruptcy in San Antonio, understanding the legal steps is vital. This process begins with obtaining court approval for the proposed property sale.

1. Court Motion and Approval

The debtor or trustee submits a motion to the bankruptcy court outlining the property details and intention to sell. The court carefully reviews these documents to determine if selling the property aligns with bankruptcy objectives and protects all parties’ interests.

2. Property Valuation and Appraisal

The next phase involves determining the property’s fair market value. An independent appraiser inspects the property to assess its worth, considering factors like location, condition, and recent comparable sales in San Antonio.

3. Marketing and Buyer Selection

Upon receiving court approval, the property can be listed for sale through traditional channels or sold directly to a cash buyer such as Sell My House Fast SA TX. Any offers must meet court-approved minimum values and terms.

4. Court Approval of Sale Terms

Once an offer is accepted, it must be reviewed and approved by the bankruptcy court. This step ensures transparency and fairness while protecting the interests of creditors and the debtor.

5. Closing and Proceeds Distribution

After obtaining final court approval and completing necessary closing documents, funds are distributed according to bankruptcy law priorities, with secured creditors typically paid first.

Challenges of Selling a Property During Bankruptcy in San Antonio

Selling a house during bankruptcy presents unique challenges due to the complex interaction between real estate law and bankruptcy regulations. This is particularly relevant for individuals undergoing this process in San Antonio, TX.

Legal and Regulatory Obstacles

- Federal Compliance: Debtors must adhere to federal bankruptcy laws governing asset sales, which often require extensive documentation and court approval.

- Automatic Stay: The automatic stay provision can complicate timing and require additional legal steps to modify or lift.

- Trustee Involvement: Depending on your bankruptcy chapter, a trustee may have significant control over the sale process.

- Creditor Rights: Secured creditors may have liens that must be addressed before or during the sale.

Financial Considerations

- Equity Distribution: Any equity from the sale may need to be distributed to creditors rather than retained by the homeowner.

- Property Maintenance: Continuing mortgage payments and maintenance costs during the sale process can strain already tight finances.

- Market Timing: Bankruptcy timelines may not align with optimal real estate market conditions.

Emotional and Practical Stress

- Family Impact: Losing the family home during bankruptcy can create additional emotional strain during an already difficult time.

- Timeline Pressure: Court-imposed deadlines may create pressure to sell quickly, potentially below market value.

- Complexity Navigation: Managing both bankruptcy proceedings and real estate transactions simultaneously requires significant attention and expertise.

Can You Sell a House After Bankruptcies?

Yes, you can sell a house after completing bankruptcy proceedings, but the specifics depend on your situation:

After Chapter 7 Discharge

If your home was protected by exemptions and you kept it through Chapter 7 bankruptcy, you can typically sell it freely after discharge. However, you’ll need to rebuild your credit and may face challenges if you need financing for a new home purchase.

After Chapter 13 Completion

Upon successful completion of a Chapter 13 repayment plan, you regain full control over your assets. Your improved payment history during the plan may actually help with future real estate transactions.

Multiple Bankruptcy Filings

If you’ve filed bankruptcy multiple times, you can still sell property, but you may face additional scrutiny from lenders and buyers. Working with experienced professionals becomes even more important in these situations.

You’re just one step from getting a FREE cash offer for your house!

Get a FREE cash offer on your San Antonio property today and move on from the headache of a stressful situation.

Exploring Sell My House Fast SA TX as an Alternative During Bankruptcy

When dealing with the sale of a property during bankruptcy in San Antonio, TX, navigating the standard real estate market can seem like an additional burden on top of already complex legal proceedings. Fortunately, Sell My House Fast SA TX offers a streamlined route that can simplify the selling process significantly.

A Simplified Process for Bankruptcy Situations

Sell My House Fast SA TX specializes in purchasing homes from individuals facing financial difficulties, including those going through bankruptcy. Here’s an overview of their process:

- Initial Consultation: Get in touch to discuss your bankruptcy situation and property details.

- Legal Coordination: They work with your bankruptcy attorney to ensure all legal requirements are met.

- Property Assessment: They provide a comprehensive evaluation of your property’s current market value.

- Cash Offer: You receive a no-obligation cash offer that can be presented to the bankruptcy court.

- Court Approval Process: They assist in preparing documentation for court approval.

- Efficient Closing: Once approved, closing can occur quickly to meet court deadlines.

Benefits for Bankruptcy Cases

Working with Sell My House Fast SA TX during bankruptcy provides several advantages:

- Speed: Fast processing helps meet court-imposed timelines and reduces carrying costs.

- Certainty: Cash offers eliminate financing contingencies that could delay or derail the sale.

- Legal Support: Experience with bankruptcy sales means they understand the required procedures.

- As-Is Purchase: No need for repairs or improvements that you may not be able to afford during bankruptcy.

This approach addresses many common obstacles encountered during bankruptcy property sales.

Benefits of Selling Your House to a Cash Buyer During Bankruptcy

Choosing to sell your house during bankruptcy to a cash buyer like Sell My House Fast SA TX offers several advantages that can ease the challenges typically associated with bankruptcy proceedings.

Speed and Efficiency

Time is often critical during bankruptcy, as court deadlines and carrying costs can create financial pressure. Cash buyers accelerate the process by:

- Immediate Offers: Receive an offer within days of your initial inquiry

- Court-Ready Documentation: Professional preparation of required legal documents

- Flexible Closing: Ability to close quickly once court approval is obtained

Reduced Financial Burden

Cash sales can minimize the ongoing costs associated with property ownership during bankruptcy:

- No Commission Fees: Eliminate real estate agent commissions (typically 6% of sale price)

- No Repair Costs: Sell the property in its current condition

- Minimal Closing Costs: Cash buyers often cover most closing expenses

Simplified Legal Process

Working with experienced cash buyers familiar with bankruptcy sales can reduce complications:

- Documentation Assistance: Help preparing motions and supporting documents for court

- Timeline Coordination: Flexible scheduling to accommodate court proceedings

- Professional Network: Access to bankruptcy-experienced attorneys and other professionals

Stress Reduction

During the emotional and financial stress of bankruptcy, a simplified sale process provides:

Reduced Uncertainty: Firm cash offers eliminate financing-related delaysmplicates your career goals and professional development.

Personalized Service: Direct communication without intermediaries

Predictable Timeline: Clear expectations and reliable closing schedule

See What Ron Had To Say About Working With Sell My House Fast SA TX

Frequently Asked Questions About Selling a House During Bankruptcy

Q: Can you sell your house after filing bankruptcy? A: Yes, but you typically need court approval during active bankruptcy proceedings. The process varies depending on whether you filed Chapter 7 or Chapter 13 bankruptcy and your property’s exempt status.

Q: What happens to mortgage payments during bankruptcy? A: You generally must continue making mortgage payments to keep your home. If you’re behind on payments, bankruptcy may provide options to catch up through a repayment plan.

Q: Can I sell my house after bankruptcy discharge? A: Yes, once your bankruptcy is discharged, you typically regain full control over exempt assets and can sell without court approval, though your credit history may affect financing options for future purchases.

Q: How long after bankruptcy can I sell my house? A: During active bankruptcy, you need court approval to sell. After discharge, you can sell immediately. The timeline depends on your specific bankruptcy type and circumstances.

Q: What if I have multiple bankruptcies? A: You can still sell property after multiple bankruptcy filings, though you may face additional challenges. Professional guidance becomes even more important in these situations.

Q: Do I need an attorney to sell my house during bankruptcy? A: While not legally required, having an attorney experienced in bankruptcy law is highly recommended to navigate the complex legal requirements and court procedures.

Helpful Resources for Bankruptcy in Texas

Navigating bankruptcy while selling your home requires reliable information and professional guidance. Here are valuable resources:

- U.S. Bankruptcy Court – Western District of Texas: Find court information, forms, and procedures for San Antonio bankruptcy cases

- Texas State Bar Bankruptcy Section: Locate qualified bankruptcy attorneys in San Antonio

- Legal Aid of Texas: Free legal assistance for qualifying low-income individuals

- HUD Housing Counseling: Free counseling services for homeowners facing financial difficulties

- Sell My House Fast SA TX: Specialized cash buying services for homeowners going through bankruptcy

Conclusion

Dealing with bankruptcy in San Antonio, Texas, while trying to sell your home can be overwhelming, particularly during an already stressful financial period. The advantages of partnering with Sell My House Fast SA TX to sell a house during bankruptcy are clear and significant. As a cash home-buying company, Sell My House Fast SA TX streamlines the process by removing obstacles that could complicate or delay the sale.

Key benefits include:

- Speed: Ability to close quickly to meet court deadlines and reduce carrying costs

- Simplicity: Streamlined process designed to work within bankruptcy legal requirements

- Certainty: Cash offers provide security in an uncertain financial situation

- Support: Professional assistance navigating both real estate and bankruptcy requirements

When you’re ready to move forward with selling your house during bankruptcy, consider contacting a trusted cash home-buying company in San Antonio. Their expertise in managing bankruptcy-related transactions ensures a smooth property transfer process while complying with all legal requirements.

For individuals seeking to sell a house during bankruptcy in San Antonio, Texas, embracing the services of Sell My House Fast SA TX could provide the solution they need. Get a no-obligation cash offer today to learn how they can help transform a challenging financial situation into a positive outcome.

You’re just one step from getting a FREE cash offer for your home!

Get a FREE cash offer on your San Antonio property today and move on from the headache of a stressful house.