Selling your house but having title problems at closing? Don’t let this ruin your home sale… We buy houses from homeowners even if there are title problems. Request a free CASH offer below!

Title Problems at Closing

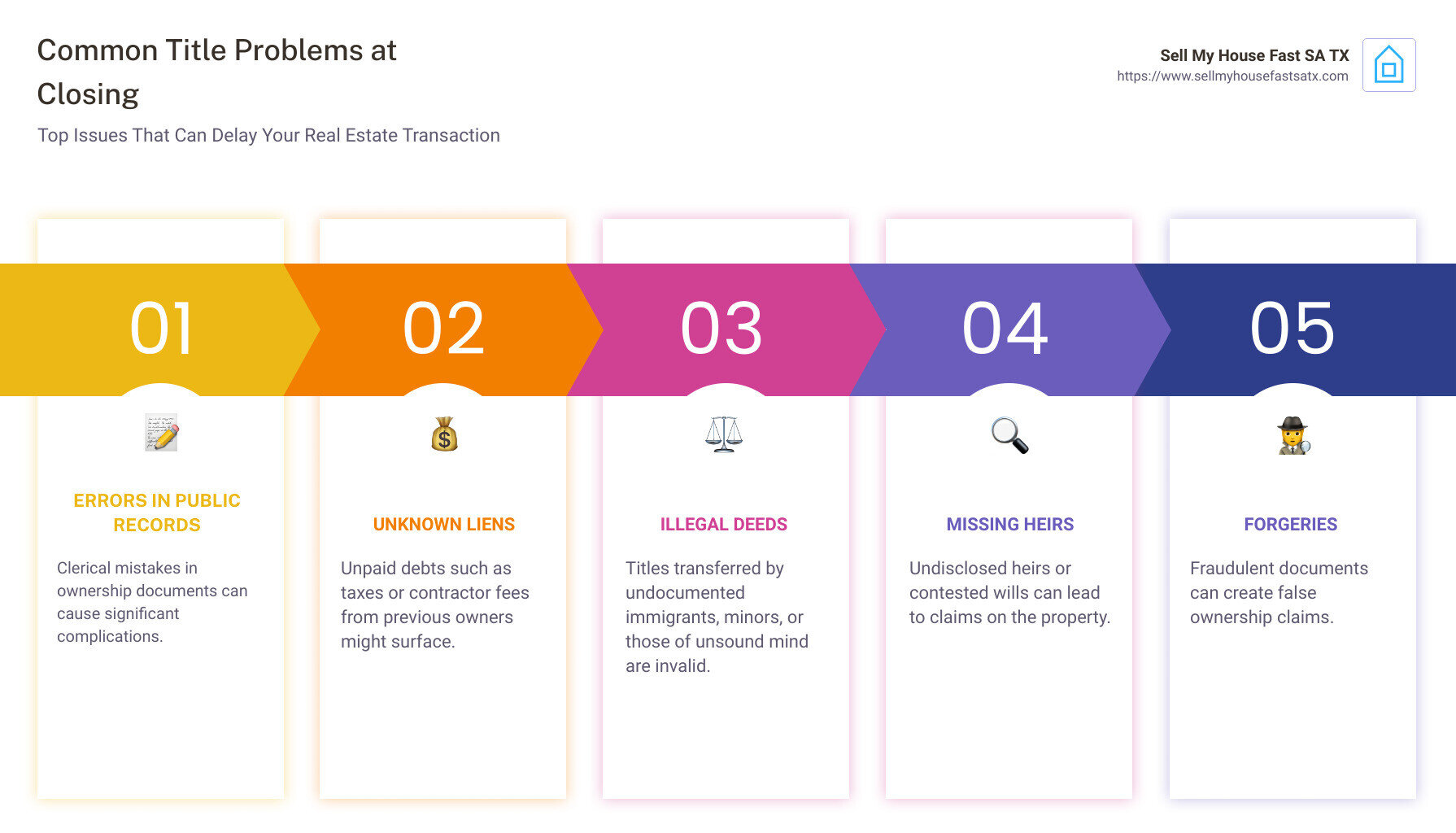

Navigating through a real estate transaction in San Antonio, TX, can be daunting, especially when title problems at closing arise. These issues can quickly derail your plans, causing delays and unexpected complications. Here’s a quick snapshot of what you need to know to tackle these obstacles effectively:

- Errors in Public Records: Clerical mistakes can complicate ownership.

- Unknown Liens: Unpaid debt from previous owners can surface.

- Illegal Deeds: Invalid past transfers affect title legitimacy.

- Missing Heirs: Unsettled estates can lead to claims on the property.

- Forgeries: Fraudulent documents can jeopardize clear title.

I’m Daniel Cabrera, founder of Sell My House Fast SA TX, and with over 15 years in real estate, I’ve helped many homeowners steer these title issues smoothly. Leveraging my extensive experience, I’ll guide you through the essential steps to ensure that title problems don’t delay your closing.

By focusing on early detection, leveraging expert help, and investing in title insurance, you can steer your property transaction to a successful close.

Common Title Problems at Closing

Navigating title problems at closing can be a headache, but understanding common issues can help you avoid delays. Let’s dive into some typical title problems that can arise during the closing process.

Errors in Public Records

Public records are not infallible. Clerical errors, filing mistakes, and deed inaccuracies can crop up, causing significant issues at closing. Even a simple typo in a property description can lead to disputes over ownership.

Example: A homeowner in San Antonio found a clerical error in the property’s legal description during the title search. This mistake delayed the sale by several weeks as the records were corrected.

Unknown Liens

Liens are legal claims against a property due to unpaid debts like property taxes, contractor fees, or mortgages. These must be resolved before the sale can proceed.

Fact: Prior owners might have left unpaid bills, resulting in liens that the new owner must clear. In San Antonio, it’s common to find tax liens or HOA liens that need addressing before closing.

Illegal Deeds

Illegal deeds can occur when a prior deed was executed by someone who didn’t have the legal capacity to do so, such as an undocumented immigrant, a minor, or someone of unsound mind. These can invalidate the chain of title, complicating ownership claims.

Case Study: A family in San Antonio found that a previous deed was signed by a minor, which led to a lengthy legal process to clear the title.

Missing Heirs

When a property owner dies, their home may be inherited by heirs. However, if these heirs are unknown or missing, it can lead to contested wills and probate issues. This can severely delay or derail the closing process.

Statistic: Missing heirs are a common problem, especially in cases where the property has been in the family for generations. Probate issues can take months, if not years, to resolve.

Forgeries

Unfortunately, forged or fabricated documents can make their way into public records, casting doubt on the rightful ownership of a property. These fraudulent claims can put your home sale at risk.

Quote: “Fraudulent documents can jeopardize clear title,” says Jacob Michal, CEO of Louisville Cash Real Estate. “It’s crucial to have thorough checks in place to catch these issues early.”

Unfunded Encumbrances

Encumbrances are claims or restrictions on a property that can affect its transfer. If not properly recorded or disclosed, they can become a major hurdle at closing.

Fact: Unfunded encumbrances often include unresolved mortgages or liens that were never fully documented or cleared.

Unknown Easements

Easements allow third parties access to your property for specific purposes, like utility maintenance. Unknown easements can restrict how you use your property and complicate the sale.

Example: A homeowner in San Antonio found out about an old utility easement only during the title search, which delayed the closing as they negotiated terms with the utility company.

Boundary Disputes

Boundary disputes arise when property lines are unclear or contested. These discrepancies can lead to legal battles and delays in closing.

Fact: Different surveys can show varying property boundaries, leading to disputes with neighbors or other parties.

Unfunded Wills

If a property owner dies without a will or the will isn’t filed correctly, it can create legal complications. Unfunded wills can lead to lengthy probate processes, delaying the sale.

Statistic: Unfunded wills are a common issue, especially in older properties where proper documentation may not have been maintained.

False Impersonation

False impersonation occurs when someone fraudulently claims to be the property owner. This can lead to serious legal complications and invalidate the sale.

Understanding these common title problems can help you steer the closing process more smoothly. In the next section, we’ll discuss how to address these issues effectively.

How to Address Title Problems

Conduct a Thorough Title Search

A thorough title search is your first line of defense against title problems. This process involves examining public records to verify the history of the property’s ownership and uncover any potential title defects.

A reputable title company can perform this search, looking for issues such as undisclosed encumbrances, easements, and errors in public records. This step ensures that any problems are identified early, giving you ample time to address them before closing.

Secure Title Insurance

Title insurance is essential for protecting yourself financially from unforeseen title issues that may arise after the sale. This insurance covers a variety of problems, including undisclosed heirs and probate issues.

There are two main types of title insurance: lender’s title insurance and owner’s title insurance. While lenders usually require a policy, an owner’s policy is optional but highly recommended. It provides peace of mind, knowing that you are protected against claims for past discrepancies.

Consult a Real Estate Attorney

When facing title problems at closing, consulting a real estate attorney is invaluable. These professionals provide legal guidance and can interpret complex title reports. They help resolve disputes, such as claims from undisclosed heirs or forged documents.

In San Antonio, TX, where local laws can complicate real estate transactions, having an attorney ensures compliance and safeguards your ownership rights. They can also assist with dispute resolution and re-filing public documents to correct errors.

You’re just one step from getting a FREE cash offer for your home with Title Issues in San Antonio!

Get a FREE cash offer on your San Antonio property today and move on from the headache of a stressful house.

Perform Due Diligence

Due diligence involves a detailed examination of the property and its title. This includes obtaining a comprehensive title report from a reputable title company. The report should identify any undisclosed encumbrances, easements, or other title defects.

Due diligence also means being proactive in addressing any issues found during the title search. Whether it’s clearing up recorded liens or resolving boundary disputes, taking these steps early can prevent delays in the closing process.

By following these steps, you can effectively address and resolve title problems, ensuring a smoother path to closing. Next, we’ll discuss specific steps to resolve common title issues.

Steps to Resolve Specific Title Issues

Chain of Title Document Errors

Chain of title errors can be a significant hurdle at closing. These errors occur when there’s a mistake in the historical sequence of property ownership. For example, a vesting deed error may arise if the property owner’s legal right is incorrectly recorded. This can lead to disputes over who truly owns the property.

To resolve these issues, you might need a correction deed. This legal document fixes inaccuracies in the public record. In some cases, a warranty deed might be required, where the seller guarantees clear title and assumes liability for any issues. Consulting a real estate attorney can help you determine the best course of action.

Missing Mortgage Assignments

Mortgage assignments are critical documents that show the transfer of a mortgage from one lender to another. Missing assignments can create confusion about who holds the lien on the property, complicating the sale.

Most of the mortgage industry uses the Mortgage Electronic Registration System (MERS) to track these assignments. However, these assignments don’t always make it to the public record. If this happens, your title company will need to identify the correct lender and ensure all documents are properly recorded.

Recorded Liens

Liens are legal claims against a property, often due to unpaid debts like tax liens, HOA liens, or mechanic’s liens. These must be cleared before a sale can proceed.

First, the title company will determine if the lien is unpaid or simply unreleased. If it’s unpaid, the seller usually must pay it off from the sale proceeds. If the lien is paid but not released, the title company will request proof of payment and have the lienholder file a release.

In some cases, sellers may refuse to pay off the lien. Buyers can then renegotiate the purchase price, proceed and clear the lien later, or cancel the contract altogether.

Boundary Discrepancies

Boundary discrepancies can lead to significant title issues. These occur when there’s a disagreement or confusion about the property lines. For example, a neighbor’s fence might encroach on your property, or there might be an easement that allows others to use part of your land.

To resolve these issues, a detailed property survey is essential. This survey will clarify the exact boundaries and identify any easements or encroachments. While easements can’t be removed, they must be disclosed to potential buyers. Encroachments might require legal action to resolve, especially if they significantly impact the property’s use.

In San Antonio, TX, resolving these common title issues with the help of real estate professionals can ensure a smoother closing process.

Next, we’ll answer some frequently asked questions about title problems at closing.

Frequently Asked Questions about Title Problems at Closing

What constitutes a defect in title?

A defect in title refers to any issue that prevents the seller from providing a clear title to the buyer. Common defects include:

- Undisclosed heirs: If a previous owner passed away and an heir was not properly recorded, that heir could later claim ownership.

- Encumbrances: These are claims or liens against the property, such as unpaid taxes, contractor fees, or mortgages.

- Ownership claims: Disputes over who holds the legal right to the property can arise, especially if past transactions were not properly documented.

What happens if the seller cannot get a clear title?

If the seller cannot provide a clear title, several outcomes are possible:

- Legal implications: The transaction may be delayed while the issue is resolved. This can involve legal fees and additional paperwork.

- Transaction cancellation: In some cases, the buyer may choose to walk away from the deal if the title issues are too complex or costly to resolve.

- Renegotiation: The buyer and seller might renegotiate the terms of the sale, possibly lowering the price to account for the title defect or agreeing on who will handle the resolution costs.

How long does it take to resolve title issues?

The timeframe to resolve title issues varies based on the complexity of the problem and the legal processes involved. Here are some general guidelines:

- Simple issues: Minor clerical errors or easily resolved liens can take a few days to a couple of weeks.

- Moderate issues: Problems like missing mortgage assignments or minor boundary disputes may take several weeks to a few months.

- Complex issues: Significant disputes over ownership, multiple undisclosed heirs, or legal proceedings can take several months to over a year to resolve.

For homeowners in San Antonio, TX, working with experienced real estate professionals can help expedite the process and ensure that title issues are handled efficiently.

Next, let’s dive into the steps to resolve specific title issues and ensure a smooth closing process.

Conclusion

Facing title problems at closing can be daunting, but with the right approach, they can be resolved efficiently. At Sell My House Fast SA TX, we specialize in making the home-selling process in San Antonio, TX, quick and hassle-free, even if there are title issues.

Our team offers a personalized service, ensuring that you get a fair cash offer for your home without the stress of repairs, cleaning, or dealing with realtors. We cover all closing costs, including those related to title issues, so you don’t have to worry about unexpected expenses.

Whether your home has minor title defects or more complex problems, we buy houses as-is. This means you can leave unwanted items behind and move on with your life without the typical hassles of selling a home.

If you’re ready for a quick and efficient sale, get in touch with us today. We’ll provide you with a cash offer and help you steer any title issues, ensuring a smooth closing process.

Here at Sell My House Fast SA TX, we provide reasonable cash offers to houses with title issues! We can wait for the title issues to be resolved and make the selling process hassle-free for you.

You’re just one step from getting a FREE cash offer for your home with Title Issues in San Antonio!

Get a FREE cash offer on your San Antonio property today and move on from the headache of a stressful house.