Why Timing Matters After Bankruptcy: Your Path to Selling Your San Antonio Home

How long after bankruptcy can I sell my house is one of the most pressing questions facing San Antonio homeowners who’ve filed for bankruptcy protection. The answer depends on your specific bankruptcy chapter and case status, but here’s what you need to know:

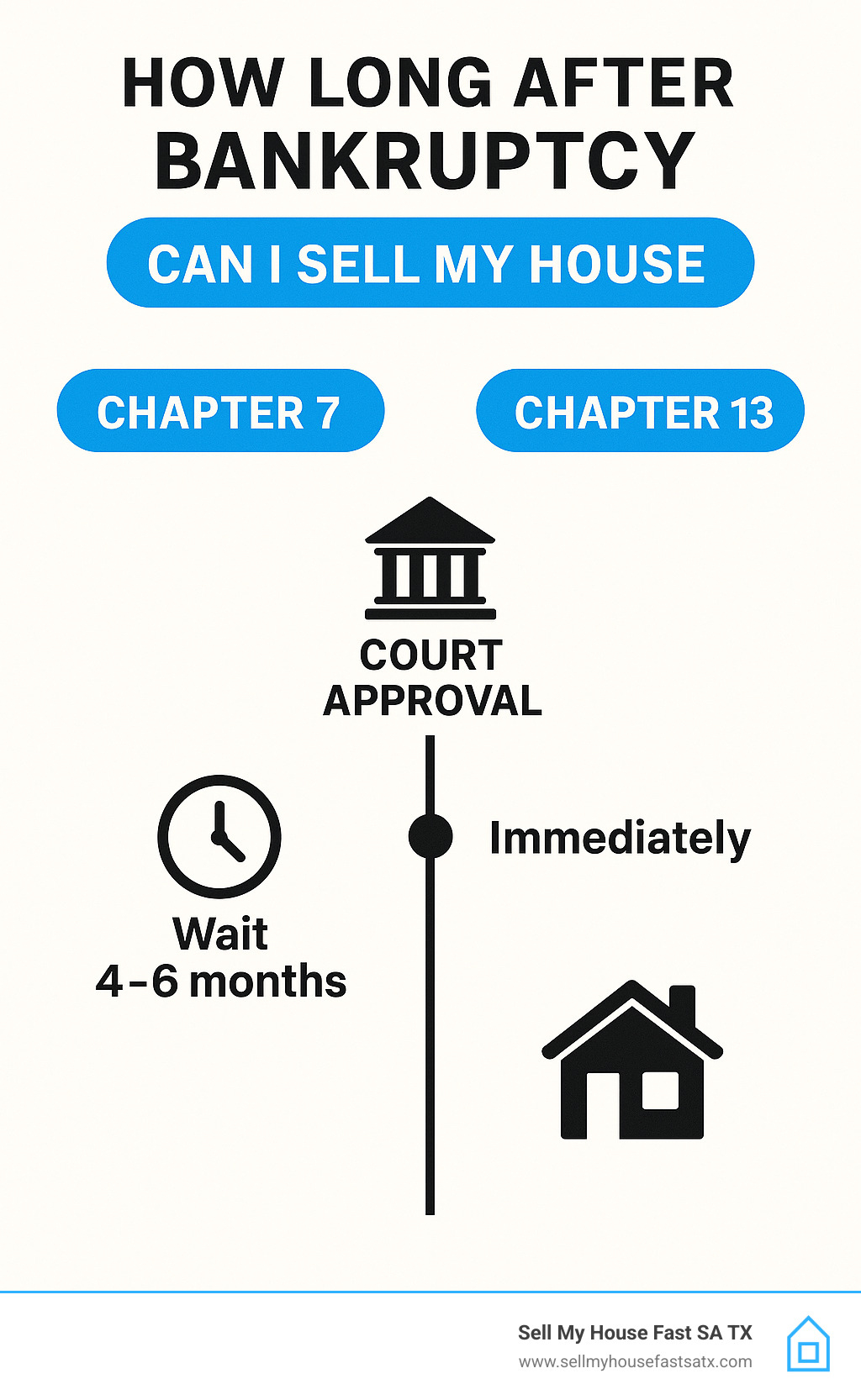

Quick Answer – Selling Timeline After Bankruptcy:

- Chapter 7: Wait until your case is officially closed (typically 4-6 months after filing)

- Chapter 13: Can sell during repayment plan with court approval, or immediately after discharge (3-5 years)

- Both: Must ensure trustee has abandoned property or case is fully closed

- Texas Advantage: Homestead exemption may protect your primary residence from liquidation

The reality is that many San Antonio homeowners feel trapped after bankruptcy, unsure of their rights and worried about making costly mistakes. You might owe more than your house is worth, need major repairs you can’t afford, or simply want to move on with your life without the stress of a traditional sale process.

The good news? With the right guidance and approach, you can sell your home quickly and move forward – even immediately after your bankruptcy case closes.

I’m Daniel Cabrera, founder of Sell My House Fast SA TX, and over my 15+ years in real estate, I’ve helped dozens of San Antonio homeowners steer the question of how long after bankruptcy can I sell my house while providing fast, cash solutions that eliminate the typical complications. My experience with over 200 property transactions has shown me exactly how to help homeowners sell quickly after bankruptcy while avoiding common pitfalls.

Understanding Bankruptcy in Texas: Chapter 7 vs. Chapter 13

If you’re asking “how long after bankruptcy can I sell my house” in San Antonio, the answer depends on which type of bankruptcy you filed. The timing for selling your home is entirely different for Chapter 7 and Chapter 13.

When you file for bankruptcy, your assets, including your home, become part of a “bankruptcy estate” managed by a court-appointed trustee. This means you can’t just sell your house whenever you want. The trustee has authority over your property until the case is resolved. Understanding this is the first step to a successful sale. Many homeowners file for bankruptcy to stop foreclosure; if this is your situation, our guide on Understanding the Foreclosure Process in Texas can provide more context.

Chapter 7 Bankruptcy: The Liquidation Path

Chapter 7 is the “fresh slate” bankruptcy that wipes out most unsecured debts in 4-6 months. However, it’s also called “liquidation bankruptcy” because the trustee can sell your non-exempt assets to pay creditors.

When you file Chapter 7, the trustee reviews your property. If your home has equity that isn’t protected by Texas’s homestead exemption, the trustee could sell it. This is why timing is critical: You cannot safely sell your home until your Chapter 7 case is officially closed with a “Final Decree.” Selling before this point is risky, as the trustee could seize your sale proceeds. If you’re in a time crunch, perhaps due to a pending foreclosure, knowing these rules is vital. Our article on how to Sell House Before Foreclosure explores these urgent situations.

Chapter 13 Bankruptcy: The Repayment Plan

Chapter 13 involves a 3-to-5-year repayment plan instead of asset liquidation. This allows you to keep your property, including your San Antonio home, while you catch up on debts. However, the court maintains oversight throughout the plan.

If you want to sell your house during an active Chapter 13 plan, you must get permission from the court and your trustee. This involves filing a motion and proving the sale is fair to your creditors. It’s a manageable process, but it requires extra steps.

Chapter 13 is often used to stop foreclosure, as the automatic stay provides immediate protection. If you’re facing this threat, our guide on how to Stop Foreclosure in TX explains how this works.

The bottom line: Chapter 7 requires waiting for case closure, while Chapter 13 requires court approval during the plan. Understanding this difference is key to knowing how long after bankruptcy you can sell your house.

The Trustee’s Role & Texas Homestead Exemption: Protecting Your Home

When asking “how long after bankruptcy can I sell my house,” you must understand the trustee’s role. The trustee is a court-appointed administrator who reviews your assets to find non-exempt property that can be sold to pay creditors. Their authority directly impacts your ability to sell your San Antonio home.

Fortunately, Texas homeowners have a powerful tool: the Texas homestead exemption. This is one of the most generous protections in the U.S. and is key to keeping your home. It allows you to protect unlimited equity in your primary residence, as long as the property meets size limits (up to 10 acres in a city like San Antonio). This means the trustee generally cannot sell your home to pay debts, regardless of its value. If you’re also dealing with inherited property, our guide on selling an inherited house may be helpful.

When is Your Bankruptcy Case Officially Closed?

This is a critical distinction. Many San Antonio homeowners confuse their discharge date with their case closure date, which can lead to costly mistakes.

- Discharge Date: This is when the court releases you from personal liability for most debts. It’s a major milestone, but your case is not over.

- Case Closure Date: This comes later, after the trustee finishes all administrative tasks, and is marked by a “Final Decree.” The trustee retains authority over your property until this date.

Why does this matter? If you sell your house after discharge but before the case is officially closed, the trustee could claim your sale proceeds. The cash from your sale may not have the same protection as your homesteaded property. For this reason, we always advise waiting for the “Final Decree.” It eliminates all risk and ensures you keep 100% of your money. You can learn more about the bankruptcy court process to understand these timelines.

Once your case is closed, you are free to sell your San Antonio home with no waiting period or court approval. That’s the perfect time to partner with Sell My House Fast SA TX for a quick, confident sale.

How Long After Bankruptcy Can I Sell My House? (Official Timelines)

Here’s the moment of truth for San Antonio homeowners: how long after bankruptcy can I sell my house? After helping dozens of homeowners through this exact situation, I can tell you the timeline depends entirely on your bankruptcy type and current case status. Understanding these waiting periods, court approval requirements, and title company expectations will save you from costly mistakes that could put your sale proceeds at risk.

The good news is that once you know the rules, you can plan your next steps with confidence. Whether you’re dealing with mounting repairs you can’t afford or simply ready for a fresh start, there are clear pathways forward. For homeowners looking to skip the traditional hassles of repairs, showings, and lengthy closings, our Sell House As Is process eliminates these complications entirely.

Chapter 7: When Can You Sell?

For Chapter 7 bankruptcy, the safest approach is waiting until your case receives that official “Final Decree” from the court. While your discharge typically happens around 4-6 months after filing, your case might remain open longer while the trustee completes administrative tasks.

Here’s why patience pays off: selling after discharge but before official closure creates a dangerous gray area. The trustee can still claim your sale proceeds if your home’s equity exceeds the Texas homestead exemption. Imagine selling your house only to find the money goes to creditors instead of your pocket – it’s a nightmare scenario we’ve seen happen to well-intentioned homeowners.

The key difference lies in trustee abandonment versus full case closure. When your home has no non-exempt equity, the trustee typically files a “Notice of Abandonment,” essentially saying they have no interest in your property. But even with abandonment, waiting for complete case closure provides the clearest legal protection.

Think of it this way: selling before case closure means you need court approval, risk having proceeds seized, and face potential title issues that complicate your sale. Selling after case closure means you have full control, clear title, and complete ownership of any proceeds. The few extra months of waiting can save you thousands of dollars and significant legal headaches.

Chapter 13: When Can You Sell?

Chapter 13 bankruptcy offers more flexibility but requires different navigation. If you’re still in your 3-5 year repayment plan, selling your San Antonio home is absolutely possible – you just need the court’s blessing first.

Selling during your repayment plan involves your bankruptcy attorney filing a “Motion to Sell” with the court. This process typically takes 30-45 days and requires explaining why you’re selling, the proposed sale price, and how you’ll handle the proceeds. The court wants to ensure the sale benefits your creditors and doesn’t derail your repayment plan. Often, sale proceeds help pay off creditors faster, potentially leading to earlier discharge.

Selling after completing your plan is much simpler. Once you’ve made all required payments and received your discharge, you’re free to sell immediately with no court approval needed. Your property is entirely yours again, and the trustee has no remaining claim or oversight.

This flexibility makes Chapter 13 particularly appealing for homeowners who want to maintain control over their property decisions. For those currently navigating an active bankruptcy and considering their options, our dedicated guide on selling your house during bankruptcy provides comprehensive details about the court approval process and what to expect.

The timeline question of how long after bankruptcy can I sell my house ultimately depends on your specific situation, but understanding these official requirements puts you in control of your next steps. Whether you’re waiting for case closure or preparing court motions, knowing the rules helps you plan for a successful sale that puts money in your pocket and stress behind you.

Navigating the Sale: Common Problems & How to Overcome Them

Once your bankruptcy case closes, selling your home should be easy, but challenges can arise. The question of how long after bankruptcy can I sell my house is often followed by problems with the sale itself.

Common problems include title search issues and lender inquiries. Title companies and mortgage lenders for potential buyers will scrutinize your bankruptcy records, demanding proof of a clear title, including the Final Decree. This can cause significant delays, especially if your case had complications. This is why working with a direct cash buyer like Sell My House Fast SA TX is a relief. With over 16 years of experience in San Antonio, we steer post-bankruptcy sales efficiently, avoiding the typical paperwork headaches for you. If you’re also facing foreclosure, our expertise with We Buy Houses in Pre-Foreclosure situations allows us to act quickly when time is critical.

Selling Your House During an Active Bankruptcy

Selling during an active Chapter 13 case requires careful legal steps. You must consult your bankruptcy attorney and file a “Motion to Sell” with the court. This process involves detailing the sale terms to prove it’s fair to creditors. After notifying all parties and getting trustee approval (which can take 30-45 days), the sale can proceed. The process can be long and expensive.

We offer a simpler path by structuring deals that meet legal requirements, removing the stress from the situation. Check our selling your house during bankruptcy page.

Buying a New Home After Bankruptcy

If you plan to buy a new home after selling, be aware of lender waiting periods. These start from your discharge date:

- After Chapter 7: Wait 2 years for FHA/VA loans, 4 years for conventional.

- After Chapter 13: Often qualify immediately for FHA/VA loans, but wait 2 years for conventional.

A quick cash sale of your current home provides the funds and flexibility needed for your next chapter. We give you that certainty without the delays or commissions of a traditional sale.

Frequently Asked Questions: Selling a House After Bankruptcy in San Antonio

San Antonio homeowners often have the same questions when selling after bankruptcy. Here are direct answers to the most common concerns.

Can the bankruptcy trustee take my house and sell it?

Yes, but it depends. In Chapter 7, the trustee can sell your home if it has significant non-exempt equity. However, the powerful Texas homestead exemption protects the equity in the primary residence for most homeowners, making a sale by the trustee unlikely. In Chapter 13, it’s extremely rare for a trustee to sell your home, as the goal is to help you keep your assets while you repay debts.

What happens if I sell my house before my bankruptcy case is officially closed?

This is extremely risky. Even after your debts are discharged, the trustee maintains control over your property until the court issues a “Final Decree” closing the case. If you sell during this period, the trustee could legally claim the proceeds from your sale to pay creditors. You could lose both your house and the money. Always wait for the official “Final Decree” to ensure you are protected.

Do I need a real estate agent to sell my house after bankruptcy?

No, and for many, it’s not the best option. A traditional sale involves commissions, repairs, showings, and uncertainty—stress you don’t need after bankruptcy. Buyers’ lenders can also get nervous about a recent bankruptcy, causing delays or failed deals.

At Sell My House Fast SA TX, we buy houses directly for cash, as-is. This means:

- No commissions or closing costs.

- No repairs or cleaning needed.

- No showings or market uncertainty.

As direct buyers, we use our own funds to purchase your home. This allows us to provide a guaranteed, fast, and reliable sale. For many San Antonio homeowners, selling directly to us is the simplest path to a fresh start.

The Fastest, Easiest Way to Sell Your San Antonio House After Bankruptcy

Bankruptcy doesn’t have to mean being stuck with a house you can’t afford or don’t want. If you’ve been wondering how long after bankruptcy can I sell my house, the answer is clear – but the path to actually selling it doesn’t have to be complicated.

At Sell My House Fast SA TX, we’ve helped dozens of San Antonio homeowners steer the post-bankruptcy landscape over our 16+ years in the local market. We understand that after going through bankruptcy, the last thing you want is more stress, uncertainty, or unexpected costs. That’s why we’ve built our entire process around making your home sale as simple and straightforward as possible.

We are a direct home buyer – this is crucial to understand. It means when we make you an offer, we’re the ones buying your house with our own funds. This gives you certainty that the sale won’t fall through and that the offer is genuine. When we say we’ll buy your house, we mean it.

Here’s what makes selling to us different after bankruptcy: No commissions, no repairs, no closing costs, and no waiting. While traditional sales can drag on for months with no guarantee of success, we can provide you with a fair cash offer the same day you contact us. We can close in as little as one week, or we’ll work with your timeline if you need more flexibility with your move-out date.

The beauty of our “as-is” purchase process is that your house doesn’t need to be perfect. Foundation issues? We’ll buy it. Outdated kitchen? No problem. Carpet that’s seen better days? We don’t care. You can even leave behind any unwanted items – we’ll handle the cleanup. This is especially valuable for homeowners coming out of bankruptcy who may not have the funds for repairs or the energy for extensive preparation.

Our approach has earned us 5-star reviews on Google and a strong BBB reputation because we focus on solving your problem, not creating new ones. We’ve seen too many San Antonio homeowners get caught up in complicated processes that promise the world but deliver headaches.

As Jennifer R., one of our recent clients, shared: “My San Antonio home needed major foundation repairs and felt impossible to sell. Daniel and the team at Sell My House Fast SA TX bought it quickly and handled everything!” Stories like Jennifer’s are exactly why we do what we do – to give homeowners a path forward when traditional methods seem impossible.

The truth is, after bankruptcy, you deserve a fresh start without the burden of a house that no longer fits your life. Whether you need to downsize, relocate for work, or simply want to start over somewhere new, we’re here to make that transition smooth and profitable for you.

Ready to move forward? The first step is getting a no-obligation cash offer for your San Antonio house. There’s no pressure, no complicated paperwork to start, and no risk. You’ll know exactly what your house is worth to us, and you can make your decision from there.

✅ Get Your Fair Cash Offer for Your San Antonio House After Bankruptcy Today!