What You Need to Know About Taxes on Selling a House in Texas

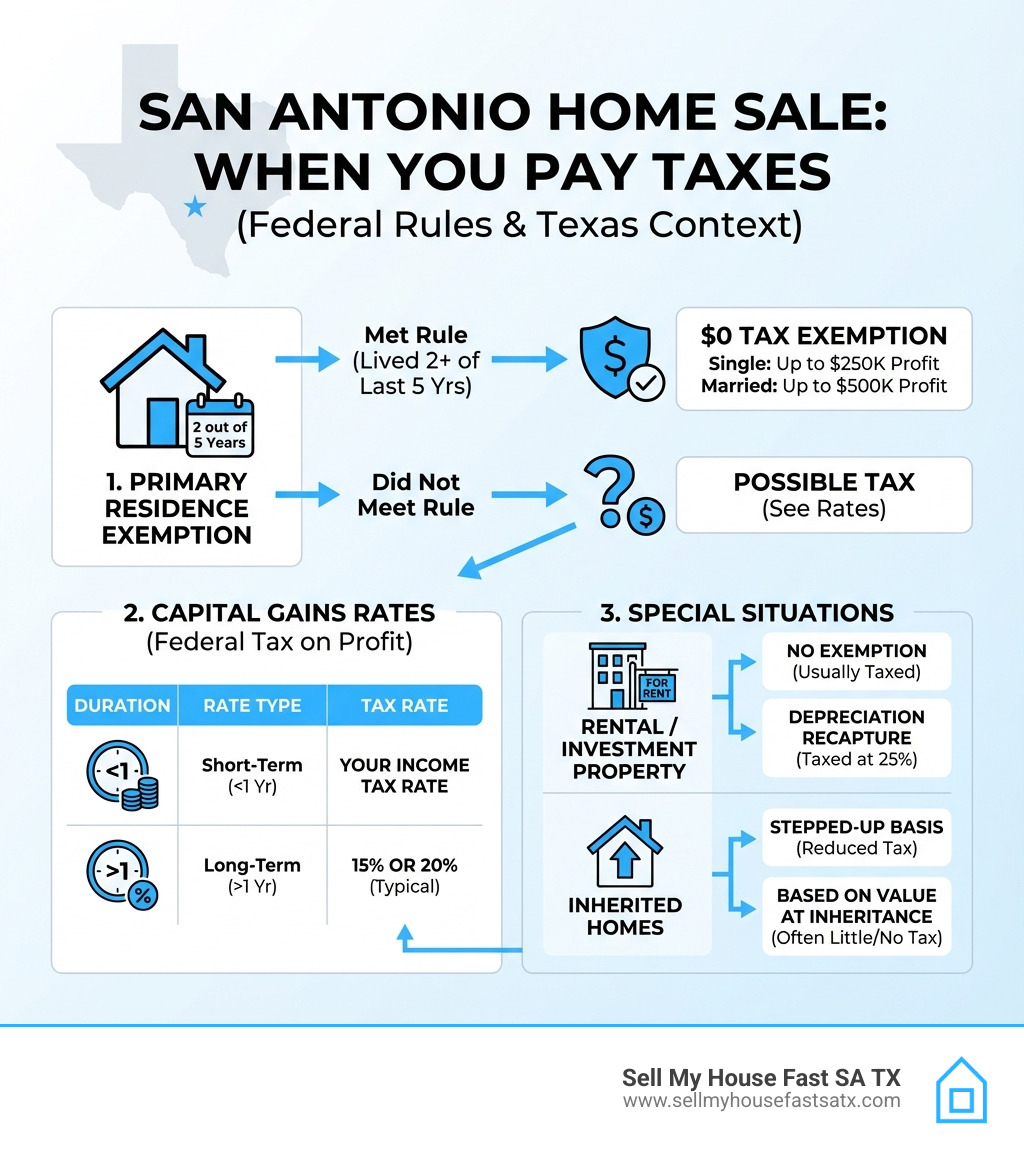

Taxes on selling a house can feel overwhelming, especially when you’re already dealing with the stress of moving, financial pressure, or an inherited property. The good news? Most San Antonio homeowners don’t pay a dime in taxes when they sell their primary residence—if they know the rules.

Here’s what you need to know right now:

- No State Tax in Texas: Texas has no state income tax, so you won’t owe the state anything on your home sale.

- Federal Capital Gains Tax: You may owe federal tax on the profit, but most sellers qualify for a huge exemption.

- Primary Residence Exemption: If you lived in your home for 2 of the last 5 years, you can exclude up to $250,000 (single) or $500,000 (married) of profit from federal taxes.

- Rental or Investment Properties: These don’t qualify for the exemption, and you’ll likely owe capital gains tax plus depreciation recapture.

- Inherited Homes: The “stepped-up basis” rule often eliminates or significantly reduces taxes when selling an inherited house.

Bottom line: If you’re selling your primary home in San Antonio and you’ve lived there for at least two years, you’ll probably owe nothing in taxes. If you’re selling a rental, second home, or inherited property, the rules get more complex—but there are still strategies to minimize what you owe.

I’m Daniel Cabrera, founder of Sell My House Fast SA TX, and over 16 years in real estate, I’ve helped hundreds of San Antonio homeowners steer the complexities of taxes on selling a house, especially when time is tight and the situation is complicated. Understanding your tax obligations upfront can save you thousands and help you make smarter decisions about your sale.

Understanding Capital Gains Tax on a Home Sale in Texas

When you sell your San Antonio home, the profit you make is generally called a capital gain. This gain is the difference between what you sold your house for and your “adjusted basis” in the property. While the concept sounds simple, the tax implications can vary greatly depending on how you used the property and how long you owned it.

Federal vs. State Tax

This is a crucial point for homeowners in San Antonio, New Braunfels, Boerne, and Helotes: Texas does not have a state income tax, which means you won’t pay any state-level capital gains tax on your property sale. This is a significant advantage compared to many other states! However, you still need to consider federal capital gains tax. The federal government will tax your profits if they exceed certain exclusion thresholds.

Long-Term vs. Short-Term Gains

The length of time you owned the property before selling plays a big role in how your capital gains are taxed:

- Short-Term Capital Gains: If you owned the property for one year or less, your profit is considered a short-term capital gain. These gains are generally taxed at your ordinary income tax rates, which can be significantly higher than long-term rates.

- Long-Term Capital Gains: If you owned the property for more than one year, your profit is a long-term capital gain. These are typically taxed at more favorable rates.

2023-2024 Federal Capital Gains Tax Rates

For long-term capital gains, the federal tax rates are generally 0%, 15%, or 20%, depending on your taxable income. For 2023, for example:

- 0% rate: Applies to taxable income up to $41,675 for single filers or $83,350 for married couples filing jointly.

- 15% rate: Applies to taxable income between $41,676 and $459,750 for single filers, or $83,351 and $517,200 for married couples filing jointly.

- 20% rate: Applies to taxable income over $459,750 for single filers or $517,200 for married couples filing jointly.

These rates only apply to the portion of your gain that is taxable after any exclusions. We highly recommend checking the latest IRS guidelines or consulting a tax professional for the most current rates and thresholds. For more in-depth information, you can explore our guide on Capital Gains Taxes in Texas.

![Tax form and calculator, alt text: “Calculating capital gains tax on a San Antonio home sale”]

The Principal Residence Exclusion: Your Biggest Tax Saver

For many San Antonio homeowners, the most important rule to understand is the principal residence exclusion. This allows you to exclude a significant portion of the profit from the sale of your main home from your taxable income. This is often the biggest tax saver when it comes to taxes on selling a house.

To qualify for this exclusion, you generally need to meet two key tests:

- The 2-in-5-Year Rule (Ownership Test): You must have owned the home for at least two years during the five-year period ending on the date of the sale.

- The Use Test: You must have lived in the home as your main home for at least two years during that same five-year period.

These two years don’t have to be continuous; they can be separate periods totaling 24 months or more within the five-year window.

Exclusion Limits

If you meet these requirements, you can exclude:

- Up to $250,000 of capital gain if you are a single filer.

- Up to $500,000 of capital gain if you are married filing jointly.

This means that if you and your spouse sell your main home in San Antonio for a $400,000 profit and meet the criteria, you likely won’t owe any federal capital gains tax! This is why most homeowners don’t pay taxes when they sell their primary residence.

You can find official guidance on these rules directly from the IRS at IRS Topic no. 701, Sale of your home.

Partial Exclusion for Unforeseen Circumstances

What if you don’t quite meet the 2-in-5-year rule? Don’t worry, there might still be hope for a partial exclusion. The IRS allows for a reduced exclusion if the main reason for your home sale was due to certain “unforeseeable events,” such as:

- Job relocation: If you had to move for a new job or transfer that was at least 50 miles farther from your home than your old job.

- Health issues: If the sale was primarily for medical reasons, such as to obtain medical care or move closer to family providing care.

- Other unforeseen events: This can include events like death, divorce, or involuntary conversion of the home.

The amount of partial exclusion you can claim is prorated based on how much of the two-year period you did meet. Understanding these exceptions can significantly reduce your tax burden. For more on whether you’ll pay taxes when you sell, check out our article Do You Pay Taxes When You Sell a House?.

Calculating Your Capital Gain

To determine your capital gain, we use a straightforward formula:

Sale Price – Selling Expenses – Adjusted Basis = Capital Gain

Let’s break down each component:

- Sale Price: This is the total amount your home sold for.

- Selling Expenses: These are the costs you incurred to sell your home. Traditionally, this would include realtor commissions, legal fees, title insurance, and other closing costs. However, when you sell to Sell My House Fast SA TX, we cover all title-related closing costs, saving you a significant chunk here!

- Adjusted Basis: This is where it gets a little more involved. Your adjusted basis is generally what you paid for the home (your purchase price) plus certain costs, such as:

- Purchase Price: The original price you paid for the home.

- Closing Costs: Some of the costs you paid when you bought the home (e.g., attorney fees, recording fees, title insurance).

- Cost of Improvements: This is critical! Any capital improvements you made to the property can be added to your basis. This includes major renovations like adding a room, replacing the roof, or upgrading the HVAC system. Regular repairs and maintenance don’t count, but improvements that add value, prolong useful life, or adapt the home to new uses do.

The Importance of Keeping Home Improvement Receipts

We can’t stress this enough: keep meticulous records of all your home improvements! These receipts directly increase your adjusted basis, which in turn reduces your capital gain and, potentially, your tax liability. If you’ve spent money upgrading your San Antonio home, those expenses could save you big on taxes. Whether it’s a new kitchen, bathroom remodel, or a new fence, hold onto those receipts. You can learn more about this at Keeping Home Improvement Receipts.

![Receipts for home renovations, alt text: “Home improvement receipts for tax purposes in San Antonio”]

When Are Taxes on Selling a House Unavoidable?

While the principal residence exclusion is a fantastic benefit for most homeowners, there are situations where you’ll likely face federal capital gains taxes.

This typically happens when you sell a property that wasn’t your main home in San Antonio, New Braunfels, Boerne, or Helotes.

Selling a Second Home, Vacation Home, or Rental Property

If you’re selling a property that falls into one of these categories, you generally won’t qualify for the $250,000/$500,000 exclusion. This means any profit you make will be subject to capital gains tax.

- Second Homes/Vacation Homes: These are properties you own but don’t use as your primary residence. The gain from their sale is taxable.

- Rental Properties/Investment Properties: These are held primarily for income or appreciation. When you sell them, the capital gain is fully taxable (at long-term or short-term rates, depending on your holding period).

Depreciation Recapture Explained

For rental or investment properties, there’s an additional tax consideration: depreciation recapture. If you’ve claimed depreciation deductions on your rental property over the years (which reduces your taxable income), the IRS will “recapture” that depreciation when you sell.

Here’s how it works: The amount of depreciation you’ve claimed (or could have claimed) reduces your property’s basis. When you sell, the portion of your gain that is attributable to prior depreciation deductions is taxed as ordinary income, up to a maximum rate of 25%. This “recaptured” depreciation is taxed separately from any remaining capital gain. It’s a complex area, and it’s why selling a rental property often requires careful tax planning.

![Rental property in San Antonio, alt text: “San Antonio rental property – tax implications”]

Selling a House in Under a Year: Flipping vs. Investing

The IRS scrutinizes short-term property sales, especially for those who frequently buy and sell homes. If you sell a property in San Antonio that you’ve owned for less than a year, the tax implications can be quite different from a long-term sale.

Business Income vs. Capital Gains

When you buy a property with the primary intent to quickly renovate and resell for profit, the IRS might consider you a “dealer” or “flipper.” In this scenario, the profit from your sale might be classified as business income rather than a capital gain.

- 100% of Profit Taxed as Income: If your profit is deemed business income, the entire amount is taxable at your ordinary income tax rates, which can be much higher than long-term capital gains rates. This classification means you lose the benefit of the lower capital gains tax rates.

- Short-Term Capital Gains Rates: Even if it’s considered a short-term capital gain (owned less than a year but not necessarily “business income”), it’s still taxed at your ordinary income rates. The distinction often comes down to your intent and the frequency of your transactions.

This is a critical area for property flippers. If you’re selling a property in San Antonio that you’ve held for less than 365 days, be prepared for closer IRS scrutiny. If you’ve found yourself in a situation with a flipped property that now has issues, like code violations, we can help. Need to sell a house with code violations from a flip?

Selling an Inherited House in San Antonio

Selling an inherited home in San Antonio, New Braunfels, Boerne, or Helotes comes with unique tax rules that can often work in your favor. The most important concept here is the “stepped-up basis.”

Stepped-Up Basis Explained

When you inherit a property, its cost basis for tax purposes is “stepped up” to its fair market value (FMV) on the date of the previous owner’s death. This is significantly different from inheriting other assets, where your basis might be the original purchase price of the deceased.

- Fair Market Value at Date of Death: This means if the home was worth $300,000 when your loved one passed away, that becomes your new cost basis, regardless of what they originally paid for it.

- How Step-Up Basis Reduces or Eliminates Taxes: If you sell the inherited property shortly after inheriting it, and its value hasn’t increased significantly since the date of death, your capital gain will be minimal or even zero. This can effectively eliminate or drastically reduce the capital gains tax you would otherwise owe. For example, if you inherit a home with an FMV of $350,000 and sell it for $355,000, your capital gain is only $5,000, not the difference between the $50,000 original purchase price and $355,000.

Even with a stepped-up basis, if you hold onto the property for a while and its value increases significantly before you sell, you will owe capital gains tax on that new appreciation. However, the stepped-up basis is a powerful tool to minimize your tax burden on inherited property. Learn more about What is a step-up in basis?.

We understand that selling an inherited house can be emotionally and financially challenging. If you need to sell an inherited house quickly and easily in San Antonio, we specialize in buying them. Explore how We buy inherited houses in San Antonio.

Other Tax Considerations When Selling Your San Antonio Home

Beyond capital gains, there are a few other tax-related items to be aware of when selling your home in San Antonio.

Property Tax Proration

Property taxes are typically paid in advance or arrears, and when you sell your home, these taxes need to be adjusted between you and the buyer.

- How Property Taxes Are Split at Closing: At closing, the property taxes for the current year are prorated. This means you, as the seller, will be responsible for the property taxes up to the closing date, and the buyer will be responsible from the closing date onward. The closing attorney or title company will handle these calculations and adjustments, ensuring that each party pays their fair share. In Texas, property taxes are a significant expense, so understanding this proration is important for your final proceeds. You can find more information about Bexar County property taxes on their official website.

Change of Property Use

If you’ve ever changed how you use your property – for example, converting your primary residence into a rental property or vice versa – this can have tax implications. The IRS calls this a “deemed disposition.”

- Deemed Disposition: When you convert a property from a principal residence to a rental (or vice versa), the IRS treats it as if you sold the property at its fair market value and immediately reacquired it at that same value. This “deemed disposition” can trigger a capital gain or loss, even though no actual sale occurred. This is particularly important for tracking your basis and understanding future tax liabilities.

- Selling a Home with a Business or Rental Portion: If you used a portion of your San Antonio home exclusively for business (like a dedicated home office) or rented out a part of it (like a basement apartment), you’ll need to allocate the sale price and expenses between the personal and business/rental portions. The business/rental portion will be treated like a non-principal residence sale, meaning it won’t qualify for the full exclusion and may be subject to depreciation recapture.

![Bexar County property tax bill, alt text: “Bexar County property tax bill for San Antonio home sale”]

Special Circumstances and Exceptions

Life happens, and sometimes major life events can alter the tax rules for selling a home. The IRS recognizes this and provides certain exceptions or considerations:

- Selling Due to Divorce: If you transfer your share of a home to your spouse or former spouse as part of a divorce settlement, there are generally no immediate tax consequences. However, the spouse who retains the home will take on your original basis, which can impact their future capital gains when they eventually sell.

- Death of a Spouse: As mentioned with inherited property, if you inherit a home from your deceased spouse, you often benefit from a stepped-up basis. Additionally, a surviving spouse can sometimes claim the full $500,000 principal residence exclusion if they sell the home within two years of their spouse’s death, provided they meet certain conditions.

- Military Service Members: For military personnel, the 2-in-5-year rule for the principal residence exclusion can be suspended for up to 10 years if you are on qualified official extended duty. This means you might still qualify for the exclusion even if you haven’t lived in your San Antonio home for the required two years within the typical five-year window due to your service.

- Non-Resident Sellers (FIRPTA): If you are a non-resident alien selling real property in the U.S., the Foreign Investment in Real Property Tax Act (FIRPTA) generally requires a withholding tax of 15% of the gross sales price. This is not a tax itself, but a prepayment of potential tax. You’ll need to file a U.S. tax return to report the sale and claim any refund if the actual tax liability is lower. This is a complex area, and non-residents should always consult with a tax professional.

Life can throw curveballs, and sometimes you need to sell your house under difficult circumstances. We understand these situations and are here to help. For instance, if you’re dealing with a complex family situation, you might find our article on Selling a house with a spouse in jail helpful.

Dealing with Property Tax Liens

A property tax lien is a legal claim against your property for unpaid property taxes. If you have a tax lien on your San Antonio home, it must be addressed before or at the time of sale.

- How Tax Liens Affect a Sale: A tax lien makes your property less attractive to buyers because it clouds the title. Any outstanding liens must be paid off to clear the title and allow the sale to proceed.

- Paying Liens at Closing: Typically, any property tax liens are paid directly from the sale proceeds at the closing table. The title company will ensure that the lien is satisfied and removed, providing a clear title to the new owner. While it means less cash in your pocket, it’s a necessary step to complete the transaction.

- Selling a House with a Tax Lien Is Possible: Don’t let a tax lien deter you from selling. It’s a common issue, and we have experience working with homeowners in San Antonio, New Braunfels, Boerne, and Helotes to steer these situations. We can help you understand your options and facilitate a smooth sale even with a lien present. Learn more about How to Sell a House with a Tax Lien.

Frequently Asked Questions about Taxes on Selling a House

Do I have to pay state capital gains tax in Texas when I sell my house?

No, Texas is one of the few states with no state income tax, which means you do not owe any state-level capital gains tax on your home sale. You only need to consider federal taxes.

What documents should I keep for tax purposes when selling a house?

You should keep the original closing documents from when you bought the house, receipts for all capital improvements, the closing statement from the sale, and any Form 1099-S you receive. These documents are crucial for calculating your adjusted basis and potential capital gains.

Can I avoid taxes if I sell my house at a loss?

No, you cannot deduct a loss from the sale of your main home on your tax return. The IRS considers your main home a personal asset, and losses on personal assets are not deductible. The rules are different for investment properties, where a loss may be deductible against other capital gains or a limited amount against ordinary income.

Why Sell Your San Antonio House to Sell My House Fast SA TX? Skip the Tax Headache and Sell for Cash

Navigating tax laws can be complex and stressful, especially if you’re dealing with an inherited property, a rental, or need to sell quickly. A traditional sale adds more complications with realtor fees, closing costs, and the uncertainty of finding a buyer.

At Sell My House Fast SA TX, we offer a straightforward solution for San Antonio, New Braunfels, Boerne, and Helotes homeowners. With over 16 years of local experience, our founder Daniel Cabrera and our team understand the nuances of the local market and your needs. We provide a fair cash offer, cover all title-related closing costs, and buy your house as-is—letting you bypass the complexities and uncertainties of the market and tax paperwork. Imagine selling your house without worrying about repairs, cleaning, or even removing unwanted items. We handle it all.

We pride ourselves on providing personalized service, making the selling process easy and stress-free. By choosing us, you save on realtor commissions and avoid the lengthy traditional selling process, getting a same-day cash offer and closing in as little as one week. Don’t let the potential headache of taxes on selling a house or the slowing market keep you from moving forward.

Ready to simplify your sale and get a fair cash offer for your house in San Antonio?

✅ Get Your Fair Cash Offer Today!