Your Guide to Stopping Mortgage Payments When Selling a House in San Antonio, TX

When do you stop paying mortgage when selling house? You stop paying your mortgage on the day your home sale officially closes. At closing, the title company uses the buyer’s funds to pay off your remaining mortgage balance directly to your lender. After that, you’re no longer responsible for any future payments.

Quick Answer:

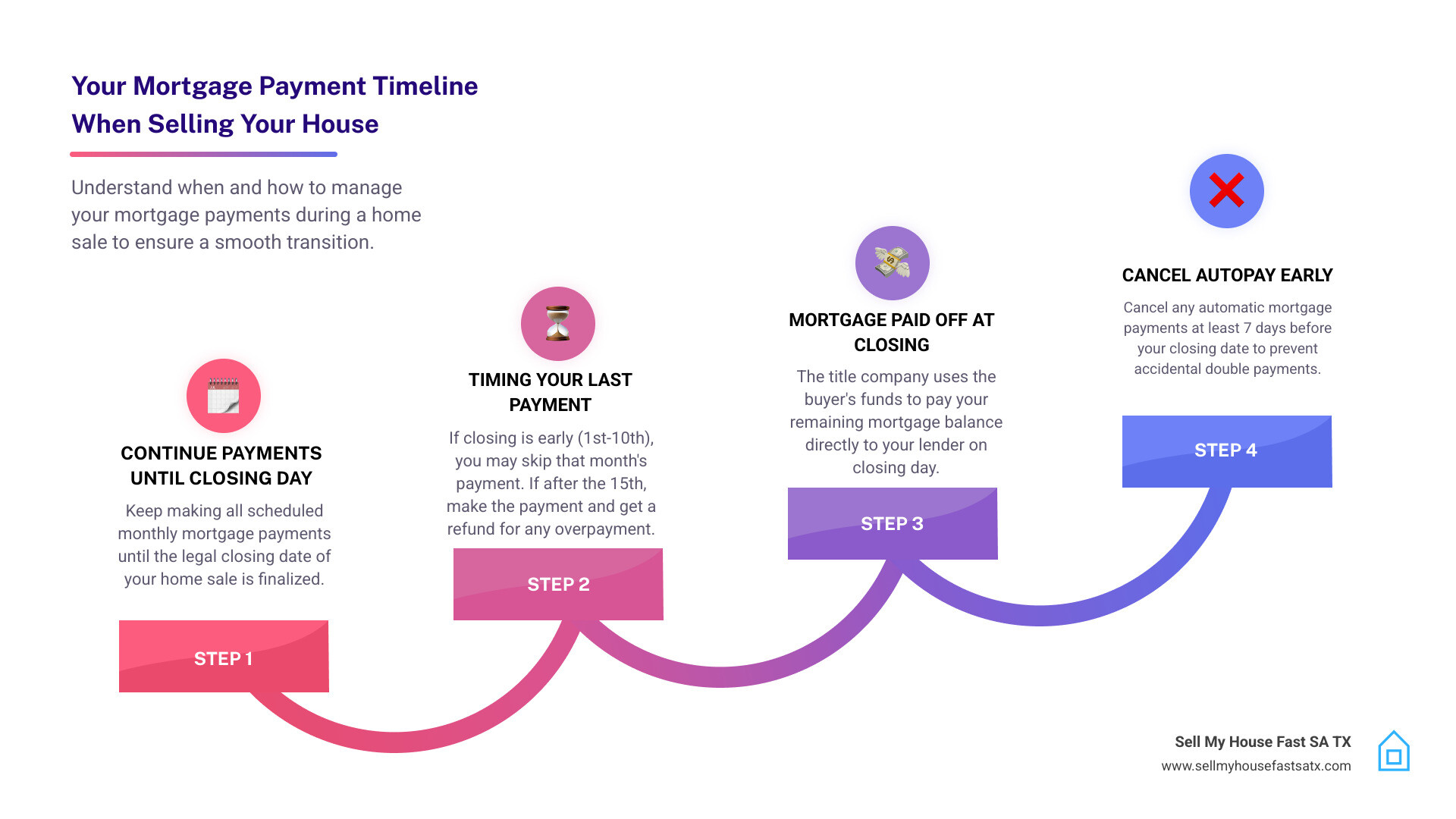

- Pay Until Closing: Continue making monthly payments until the sale is legally finalized.

- Last Payment Timing: Your last payment depends on your closing date. If closing is after the 15th, make the payment and get a refund for any overage.

- Payoff at Closing: Your lender is paid directly from the sale proceeds.

- Cancel Autopay: Stop automatic payments at least a week before closing to avoid double payments.

If you’re facing financial strain in San Antonio, the traditional selling process—averaging 43 days—can be painfully slow. Each month means another mortgage payment, plus taxes, insurance, and upkeep.

The good news? There’s a faster way.

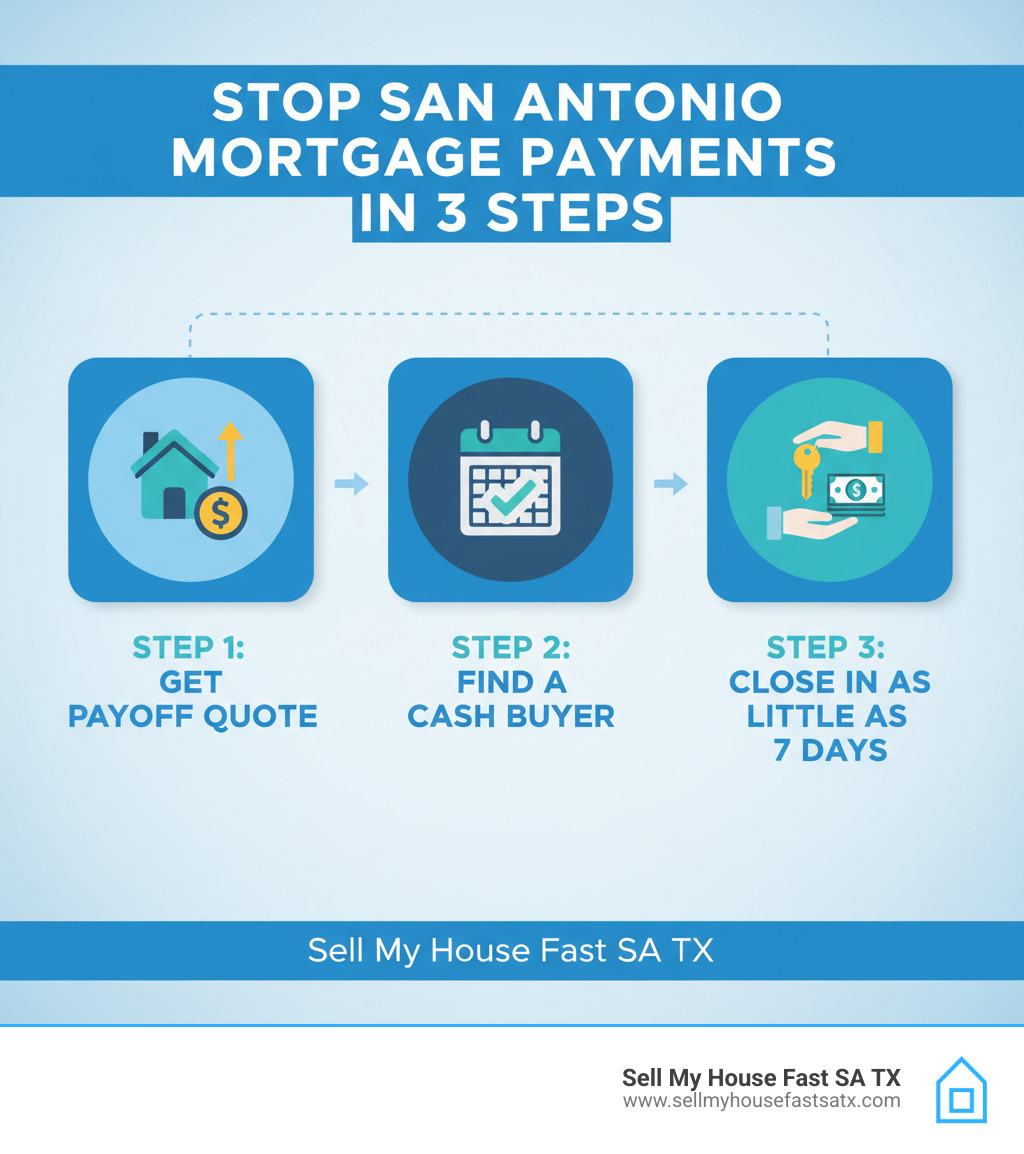

When you sell to a cash buyer like Sell My House Fast SA TX, you can close in as little as 7 days. This means you stop making mortgage payments almost immediately. No repairs, no showings, and no uncertainty.

I’m Daniel Cabrera, founder of Sell My House Fast SA TX. With over 16 years of experience buying houses in San Antonio, I’ve helped hundreds of homeowners understand when to stop paying their mortgage when selling and guided them to a fast, stress-free closing. Let me show you how to stop your mortgage payments for good.

Step 1: Know Your Final Mortgage Payoff Amount

To understand when you stop paying your mortgage when selling a house, you first need to know your exact payoff amount. This isn’t just the balance on your statement; it’s the total sum required to completely satisfy the loan, including principal, accrued interest up to the closing day, and any potential fees.

To get this number, you must request a mortgage payoff statement from your lender. This document is crucial because interest accrues daily, so the amount you owe changes every day. The payoff quote is typically valid for a 10 to 30-day window.

Your statement will detail prorated interest (the daily interest from your last payment to closing) and any prepayment penalties, which are fees for paying off a loan early. While not common, it’s wise to check with your lender to avoid surprises. If you have a second mortgage or a home equity loan (HELOC), you’ll need a separate payoff statement for each.

Finally, the statement will clarify how your escrow account (for property taxes and insurance) will be handled. Any surplus is refunded to you after closing. Knowing your payoff amount is the first step to calculating your net proceeds. When you work with Sell My House Fast SA TX, we coordinate with your lender and cover title-related closing costs, simplifying this entire process for you.

How the Mortgage Payoff Process Works in San Antonio

In San Antonio, the mortgage payoff is managed by a neutral title company or escrow agent. They ensure the transaction is handled correctly.

- Request Payoff Statement: You get the payoff quote from your lender, which tells the title company the exact amount to pay.

- Funds Disbursed at Closing: The title company uses the buyer’s funds to wire the payoff amount directly to your lender. This ensures the property lien is released promptly.

- Receive Net Proceeds: After the mortgage, closing costs, and any other liens are paid, the remaining funds—your net proceeds—are disbursed to you.

A traditional sale takes about 43 days from offer to close, meaning over a month of extra payments. With Sell My House Fast SA TX, you can close in as little as 7 days, stopping those payments almost immediately and saving you thousands.

If you’re dealing with complex issues like tax liens, we can help. More on how we handle complex situations like tax liens.

Handling Escrow and Prorated Interest

Your mortgage payment often includes property taxes and homeowners insurance, held in an escrow account. When you sell, what happens to this money?

First, prorated interest is calculated. Since mortgage interest is paid in arrears (for the previous month), the title company calculates the interest you owe from your last payment up to the closing date. This amount is added to your final payoff.

As for your escrow account, after the mortgage is paid off, your lender will close it. If there’s a surplus, you’ll receive a refund check, typically within 30 days. In rare cases of a shortage, the difference will be added to your payoff amount.

All these figures will be itemized on your Closing Disclosure (CD), which you receive at least three days before closing. Review it carefully to ensure there are no surprises.

Step 2: When Do You Stop Paying Mortgage When Selling House?

The answer to when do you stop paying mortgage when selling house? is simple but critical: you must continue making regular mortgage payments until your home sale officially closes.

Even with an accepted offer, you are legally responsible for monthly payments. Skipping a payment can lead to late fees, credit score damage, and could even jeopardize the sale. Your responsibility ends on the closing date.

Your mortgage is usually due on the first of the month, with a 10-15 day grace period. The timing of your closing date determines your final payment strategy.

What to Do if Closing is Near Your Payment Due Date

Navigating the final payment can be tricky. Here are the common scenarios for San Antonio homeowners:

- Closing Early in the Month (1st-10th): You may be able to skip that month’s payment, as the sale proceeds should pay off the loan before it’s considered late. However, always confirm this with your lender and closing agent.

- Closing Mid-Month (10th-15th): This is a gray area. To be safe, I always recommend making the payment. You will be refunded for any overpayment, and it protects you from late fees if the closing is unexpectedly delayed.

- Closing After the 15th: Definitely make the mortgage payment for that month. You will be reimbursed for any overpayment after closing. The risk of a late payment and associated fees is too high.

The safest rule is: when in doubt, make the payment. A missed payment can cause major problems, while an overpayment simply results in a refund check.

Should You Cancel Mortgage Autopay When Selling?

Yes, but timing is crucial. Cancel your autopay at least 7 days before your scheduled closing date. This prevents an accidental double payment—one from your bank and one from the closing proceeds.

Contact your lender to cancel the automatic withdrawal and get written confirmation. If a payment is accidentally made, it will be refunded, but canceling in advance saves you the hassle.

If you’re already behind on payments, this process can feel overwhelming. We help San Antonio homeowners in this exact situation every week. If you’re behind on payments, we can still help. By closing in as little as 7 days, we can help you stop the stress of mortgage payments almost immediately.

Step 3: Handle Special Scenarios and Finalize the Sale

Selling a house in San Antonio can be complicated by financial hardship, an inherited property, or a home needing major repairs. These situations make the traditional selling process difficult, but you have options.

Whether you’re facing pre-foreclosure, own a vacant house, or inherited a property, the question remains: when do you stop paying mortgage when selling house? The answer is always on closing day—but getting there requires the right strategy for your situation.

What if Sale Proceeds Don’t Cover the Mortgage?

If your mortgage balance plus selling costs is more than your home’s sale price, you have negative equity, or are “underwater.” This is a stressful situation, especially as the San Antonio market cools.

If you’re underwater, you have a few options. You could pay the difference out-of-pocket at closing, attempt a lengthy short sale with your lender (which damages your credit), or sell to a cash buyer who can steer these complexities.

At Sell My House Fast SA TX, we specialize in these situations. We work with homeowners to find solutions that traditional buyers can’t offer. If you’re facing pre-foreclosure, speed is essential. Understanding the pre-foreclosure process in Texas shows why a fast sale is your best defense.

Can You Sell Your House Fast with a Mortgage?

Yes, and it’s what we do every day. Sell My House Fast SA TX specializes in buying houses with existing mortgages, even if you’re behind on payments. We handle all the paperwork and pay off your mortgage at closing, making the process simple for you.

We are direct cash buyers, not wholesalers. We use our own funds, so there’s no risk of financing falling through. We buy houses as-is, so you don’t spend anything on repairs or cleaning. Foundation issues, a bad roof, or an outdated kitchen are no problem for us.

We also handle complex situations like inherited properties or homes with tax liens. More on how we handle complex situations like tax liens.

The benefit of our process is speed. You can stop making mortgage payments in as little as 7 days, instead of waiting months for a traditional sale. We eliminate the ongoing costs and worry, pay off your mortgage, and give you the net proceeds.

Your Post-Closing Checklist: What Happens After the Mortgage is Paid Off

Congratulations on selling your San Antonio house and paying off your mortgage! Before you celebrate, a few final steps will ensure everything is properly wrapped up.

Documentation and Final Responsibilities

After closing, your lender is required to provide you with a lien release document (also known as a Deed of Reconveyance or Certificate of Satisfaction). This legal document proves your debt is paid. The lender sends it to the county recorder’s office to clear the title, and you should receive a copy for your records.

You will also get a final closing statement from the title company detailing all financial aspects of the sale. Keep this important document.

What about other obligations?

- Property Taxes: The new owner is now responsible for property taxes. The title company prorates these at closing, so you are clear of future bills. It’s still a good idea to verify that county records are updated.

- Homeowners Insurance: Cancel your policy or remove the property from it. You no longer have an insurable interest in the home.

- Credit Report: Paying off a mortgage is great for your financial health. You might see a temporary dip in your credit score due to changes in your credit mix or average account age, but this is usually minor and short-lived. Equifax explains why this can happen.

How does selling a house with a mortgage impact a seller’s credit score?

Paying off your mortgage is overwhelmingly positive for your credit in the long run. While closing a large, long-term account might cause a slight, temporary dip in your score, the benefits far outweigh this.

By paying off the loan, you significantly improve your debt-to-income ratio, a key factor for future lenders. It also proves you are a responsible borrower. As long as you made all your payments on time during the selling process, the overall impact on your credit will be positive.

The financial freedom you gain from selling your home and eliminating that debt is the most important outcome.

The Single Easiest Step to Stop Your Mortgage Payments in San Antonio

We’ve covered the traditional process for when you stop paying your mortgage when selling a house. It’s often slow, complicated, and full of uncertainty.

There is a much simpler path.

When you sell to Sell My House Fast SA TX, you bypass the entire hassle and can stop making mortgage payments in as little as seven days. No waiting for a buyer, no worrying about their financing, and no paying commissions while your mortgage payments continue to drain your bank account.

A traditional sale in San Antonio can take 45 to 90 days to close after you accept an offer. During that time, you’re still paying the mortgage, taxes, insurance, and maintenance. With our process, you can close in one week. Your final mortgage payment could be just days away.

We offer a clear advantage:

- Guaranteed Cash Sale: No risk of buyer financing falling through.

- No Extra Costs: We cover title-related closing costs, and you pay zero agent commissions.

- Sell As-Is: We buy your house in its current condition. No repairs, no cleaning, no stress.

This is especially important as the San Antonio market cools and houses sit longer. Every month you wait is another mortgage payment and a gamble on the market. Sell Your House Now and lock in your price.

Skip the Hassle and Get a Guaranteed Cash Offer

At Sell My House Fast SA TX, we’ve perfected a simple process for homeowners in San Antonio, New Braunfels, Boerne, and Helotes. Our founder, Daniel Cabrera, brings 16+ years of local expertise to provide fair, fast solutions.

The process is simple: contact us, get a same-day cash offer, and if you accept, we can close in as little as a week. We buy houses in any condition and offer flexible move-out dates.

If you’re behind on payments or facing pre-foreclosure, time is your enemy. We can close fast enough to help you avoid foreclosure and protect your financial future. We buy houses in pre-foreclosure, handling all the complexities so you can move on.

Frequently Asked Questions: Stopping Mortgage Payments When Selling in San Antonio

Here are answers to the most common questions we hear from San Antonio homeowners about stopping their mortgage payments.

How quickly can I stop making mortgage payments if I sell to Sell My House Fast SA TX? You stop making payments the day we close, which can be in as little as one week. A traditional sale can take 45-90 days, but our process provides immediate financial relief.

What if I’m behind on my mortgage payments—can I still sell? Yes. This is a common situation we handle. We can buy your house and pay off your outstanding mortgage at closing, helping you avoid foreclosure. The key is to act fast. If you’re behind on payments, we can still help.

Will I owe anything at closing? No. Our cash offer is straightforward. We cover all title-related closing costs, so there are no surprise fees. You’ll know exactly what you’ll receive before signing anything.

How does the process work if my house needs major repairs? It doesn’t matter to us. We buy houses in San Antonio completely as-is. You don’t spend any money on repairs, renovations, or even cleaning. We handle everything.

Can I sell my house if I have a tax lien? Yes. We have extensive experience resolving tax liens as part of the sale process, allowing you to sell your home and move forward without that burden. More on how we handle complex situations like tax liens.

Get Your Fair Cash Offer and Stop Paying Your Mortgage Today!

You now know when you stop paying the mortgage when selling a house. But in today’s cooling San Antonio market, the traditional route means months of continued payments, commissions, and uncertainty.

Why endure that stress? There’s a faster, simpler way.

With Sell My House Fast SA TX, you get a guaranteed cash offer with no commissions and no closing costs. We can close in as little as one week, meaning you can stop making mortgage payments almost immediately. No repairs, no showings, and no sleepless nights.

Get your no-obligation cash offer today and take the first step toward stopping those mortgage payments for good!

✅ Get Your Fair Cash Offer Today!