How to Sell a House with Tax Lien in San Antonio, TX

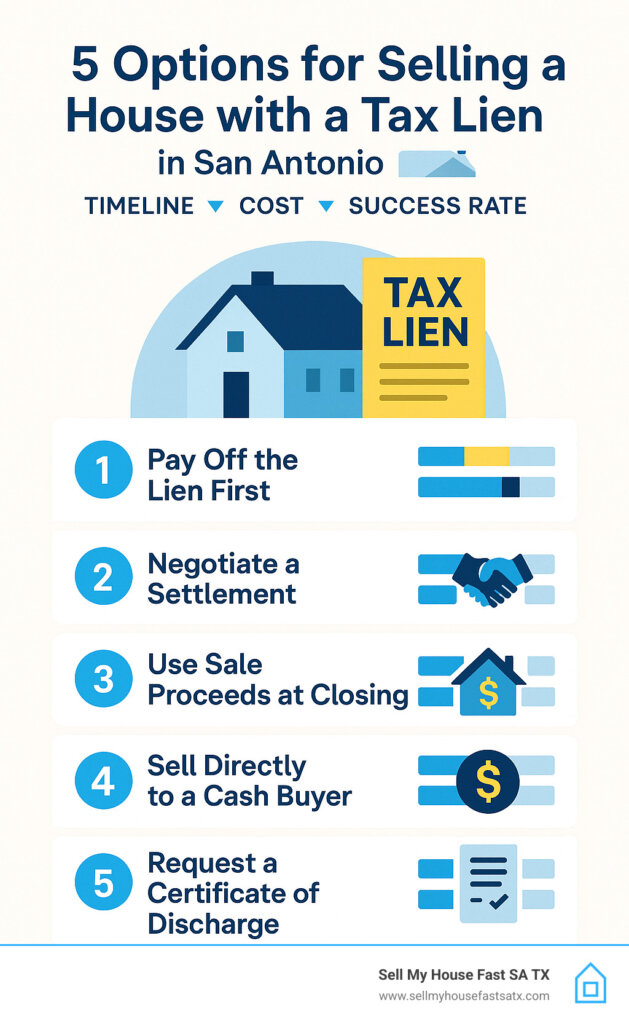

Navigating financial difficulties that lead to tax liens can feel overwhelming. This is especially true when you’re wondering “can I sell my house with a tax lien” in San Antonio, TX, where financial obligations and legal complexities can create significant obstacles to homeownership.

Tax liens represent claims by government agencies against your property due to unpaid taxes. These liens can complicate the home selling process, making it time-consuming, legally complex, and financially demanding.

Fortunately, there are solutions tailored for homeowners facing these challenging situations.

In the following sections, we’ll explore what tax liens entail in San Antonio, TX, examine how a reputable home-buying company can facilitate selling your property with tax complications, and offer guidance on navigating the process of selling during financial hardship.

Understanding Tax Liens and Their Impact on Property Sales in San Antonio, Texas

A tax lien is a legal claim placed by government agencies against your property when taxes remain unpaid. Understanding this process is crucial when considering whether you can sell your house with various types of tax liens.

Tax liens serve several functions:

- Security: They provide government agencies with security for unpaid tax debts.

- Priority: They establish the government’s priority claim on property proceeds.

- Collection: They ensure tax obligations are addressed before property transfers.

- Legal Protection: They protect government interests in collecting owed taxes.

Can I Sell My House With a Tax Lien?

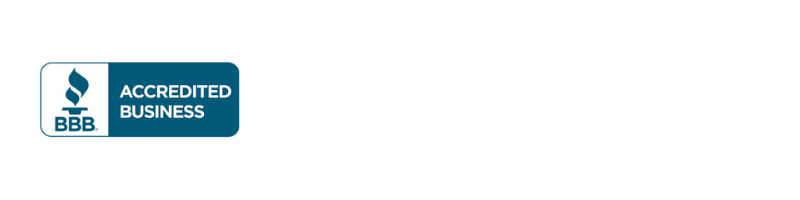

Yes, you can sell your house with a tax lien, below are 5 options on how to do it:

- Pay off the lien first – Use savings or loans to clear the debt before listing

- Negotiate a settlement – Work with the IRS or county to reduce the amount owed

- Use sale proceeds at closing – Arrange for the lien to be paid from your home’s sale price

- Sell directly to a cash buyer – Skip traditional sales complications and close fast

- Request a certificate of discharge – Get IRS approval to sell while still owing taxes

The process involves careful coordination between multiple parties to ensure all legal requirements are met while protecting the interests of both sellers and buyers.

Can I Sell My House With a State Tax Lien?

State tax liens can be particularly complex because they involve state-specific regulations and procedures. In Texas, selling a house with a state tax lien requires understanding both state and federal requirements.

Key considerations for state tax liens include:

- State Priority: State tax liens often have priority over other debts

- Redemption Rights: Some states provide redemption periods that can affect sales

- Documentation Requirements: State agencies may require specific forms and procedures

- Payment Processing: State tax payments must go through proper channels

- Release Procedures: Each state has different processes for releasing liens after payment

Working with professionals familiar with Texas state tax procedures is essential for navigating these requirements effectively.

Can You Sell a House With an IRS Tax Lien?

Federal tax liens from the IRS present unique challenges when selling property. The IRS has significant authority in these situations, but sales are still possible with proper handling.

IRS tax lien considerations include:

- Federal Priority: IRS liens often take precedence over other claims

- Certificate of Discharge: The IRS may issue a certificate allowing the sale

- Subordination Options: In some cases, the IRS may subordinate their lien

- Payment Arrangements: The IRS may accept payment from sale proceeds

- Professional Guidance: Tax attorneys or enrolled agents can help navigate IRS procedures

The IRS often works with taxpayers to facilitate property sales that will help satisfy tax obligations, making this process more manageable than many homeowners expect.

Can You Sell a House With a Property Tax Lien?

Property tax liens are among the most common types of liens affecting home sales. These liens are placed by local government entities for unpaid property taxes.

Property tax lien characteristics:

- Local Priority: Property tax liens typically have high priority status

- Annual Accumulation: Unpaid property taxes accumulate annually with interest and penalties

- Foreclosure Risk: Extended non-payment can lead to tax foreclosure proceedings

- Title Impact: These liens must be resolved for clear title transfer

- Settlement Requirements: Payment is usually required at closing

Local tax authorities in San Antonio are often willing to work with homeowners to facilitate sales that will resolve outstanding property tax obligations.

The Process of Selling a House With Tax Liens in San Antonio, TX

When handling the sale of a property with tax liens in San Antonio, understanding the procedural steps is vital. This process begins with assessing your financial situation and determining the best path forward.

1. Lien Assessment and Documentation

The first step involves obtaining comprehensive information about all existing tax liens. This includes contacting relevant agencies to determine exact amounts owed, including principal, interest, and penalties. Gathering this documentation provides a clear picture of what must be resolved during the sale.

2. Property Valuation and Equity Analysis

The next phase involves evaluating the property’s current market value compared to all outstanding liens and debts. A professional appraiser inspects the property to assess its worth, considering factors like location, condition, and recent comparable sales in San Antonio. This analysis determines whether sufficient equity exists to satisfy liens and provide proceeds to the homeowner.

3. Exploring Sale Options and Offers

Upon completing the assessment, homeowners can explore different sale options. This might include listing with a traditional real estate agent or considering a cash offer from a buyer such as Sell My House Fast SA TX. Cash buyers often have experience handling properties with tax liens and can streamline the resolution process.

4. Lien Resolution Planning

Once an offer is accepted, a detailed plan for lien resolution must be developed. This involves coordinating with tax authorities, title companies, and legal professionals to ensure all liens are properly addressed at closing. The plan should account for payoff amounts, required documentation, and timing considerations.

5. Finalizing the Transaction

After all parties agree on the lien resolution plan, the closing process proceeds. Funds from the sale are used to satisfy tax liens first, with any remaining proceeds distributed according to legal priorities. Proper documentation ensures the liens are officially released and the buyer receives clear title.

You’re just one step from getting a FREE cash offer for your house!

Get a FREE cash offer on your San Antonio property today and move on from the headache of a stressful situation.

Challenges of Selling a Property With Tax Liens in San Antonio

Selling a property with tax liens presents unique challenges that can complicate the process. Understanding these obstacles helps homeowners prepare for what lies ahead when they need to sell their house during bankruptcy or financial hardship.

Financial and Legal Obstacles

- Complex Calculations: Determining exact lien payoff amounts can be complicated due to accumulating interest and penalties

- Multiple Agencies: Different types of tax liens may involve federal, state, and local agencies with varying procedures

- Priority Disputes: Understanding which liens have priority can affect how sale proceeds are distributed

- Documentation Requirements: Each agency may require specific forms and procedures for lien release

Property Maintenance During the Process

While navigating tax lien resolution, property maintenance becomes a concern. Homeowners facing financial difficulties may struggle with ongoing maintenance costs, potentially affecting property value and marketability.

Emotional and Financial Stress

Properties with tax liens often represent financial distress for families. Having to address these issues while trying to sell can create additional emotional burden and complicate decision-making processes.

How Long Does It Take To Sell a House With Tax Liens?

The timeline for selling a house with tax liens varies significantly based on several factors:

- Complexity of Tax Obligations: Multiple liens or large amounts owed can extend the process as agencies require more time for review and approval.

- Agency Response Times: Government agencies operate on their own schedules, which can affect how quickly lien releases are processed.

- Market Conditions: Current real estate market conditions in San Antonio influence how quickly buyers show interest in your property.

- Professional Support: Working with experienced professionals can expedite the process through their knowledge of procedures and agency contacts.

- Sale Method: Traditional listings may take longer than cash sales due to buyer financing and contingency requirements.

Typical Timeline for Tax Lien Property Sales in San Antonio, TX

On average, selling a house with tax liens in San Antonio typically ranges from 3-6 months, though this can vary significantly based on the specific circumstances. Cash sales often complete more quickly than traditional financing arrangements.

Working with companies like Sell My House Fast SA TX can potentially reduce this timeline due to their experience with tax lien situations and cash purchasing capability.

Exploring Sell My House Fast SA TX as an Alternative for Tax Lien Properties

When facing the challenge of selling a property with tax liens in San Antonio, TX, traditional real estate markets can seem overwhelming with their complex requirements and lengthy procedures. Sell My House Fast SA TX offers an alternative approach that can significantly streamline the selling process for homeowners dealing with tax complications.

A Specialized Process for Tax Lien Properties

Sell My House Fast SA TX has experience working with properties affected by various financial complications, including tax liens. Here’s how their process works:

- Initial Consultation: You contact them with details about your property and its tax lien situation.

- Comprehensive Assessment: They evaluate your property while considering the impact of existing tax liens on the transaction.

- Fair Cash Offer: You receive a no-obligation cash offer that accounts for lien resolution requirements.

- Lien Coordination: They work with you to coordinate lien payoff and resolution during the closing process.

- Streamlined Closing: The transaction can often be completed within 7-14 days, depending on agency response times for lien releases.

This approach addresses many of the complications typically associated with selling properties that have tax obligations.

Benefits of Working With Experienced Cash Buyers

Choosing to work with Sell My House Fast SA TX for your tax lien property provides several advantages:

- Experience: Their team understands the complexities of tax lien resolution and can navigate the process efficiently

- Cash Transactions: Cash deals eliminate financing contingencies that could complicate lien resolution

- As-Is Purchases: They buy properties in their current condition, eliminating the need for costly repairs

- Professional Coordination: They can coordinate with tax authorities and legal professionals to ensure proper lien handling

This comprehensive approach addresses the unique challenges faced by homeowners dealing with tax liens while providing a path forward during difficult financial circumstances.

Benefits of Selling Your House With Tax Liens to a Cash Home Buyer

When you need to sell your house during bankruptcy or resolve tax lien issues, choosing a cash home buyer like Sell My House Fast SA TX offers distinct advantages over traditional sales methods.

Speed and Efficiency

Time is often critical when dealing with tax liens, as interest and penalties continue to accumulate. Cash home buyers provide faster solutions:

- Immediate Assessment: Get a property evaluation and offer quickly, avoiding lengthy listing periods

- Rapid Closing: Complete transactions in 1-2 weeks rather than months with traditional sales

- Streamlined Process: Bypass many of the complications associated with traditional real estate transactions

No Property Preparation Required

Properties with tax liens often need repairs or updates, but cash buyers typically purchase homes in their current condition. This eliminates the need to invest additional money in a property when finances are already strained.

Simplified Financial Resolution

Working with cash buyers can simplify the financial aspects of lien resolution:

- Direct Coordination: Experienced cash buyers can coordinate directly with tax authorities

- Closing Cost Coverage: Many cash buyers cover closing costs, reducing your financial burden

- Clear Net Proceeds: You’ll know exactly what proceeds will be available after lien resolution

Reduced Stress and Complexity

During financially difficult times, having a straightforward transaction process provides significant relief. Companies like Sell My House Fast SA TX offer personalized support to help sellers navigate these challenges while minimizing stress and uncertainty.This approach ensures a smooth sale experience, allowing you to move forward quickly and confidently, regardless of your property’s condition.

Why a Fast Cash Sale is the Easiest Way to Sell a House with a Tax Lien

When facing a tax lien, time is often of the essence. A fast cash sale offers unparalleled advantages compared to a traditional listing, especially in a market where traditional sales are slowing down.

| Feature | Traditional Sale | Sell My House Fast SA TX |

|---|---|---|

| Speed | 30-90+ days | Close in as little as 7 days |

| Repairs Needed | Yes | No |

| Commissions | 6%+ | $0 |

| Closing Costs | 2-5% | $0 (we pay all costs) |

| Handles Tax Lien | No | Yes |

| Certainty | Low | Guaranteed cash offer |

| Stress Level | High | Low |

- Avoid Foreclosure and Legal Headaches: If you’re behind on taxes, a fast sale can prevent the government from initiating foreclosure proceedings. We work FAST to help ensure that your house doesn’t go to foreclosure, helping you save your credit and avoid the public record of a foreclosure.

- No Showings, No Cleaning, No Repairs: Imagine selling your house without the hassle of preparing it for market. With us, you skip the endless showings, expensive repairs, and deep cleaning. We buy your property as-is, exactly as it is today. You don’t even have to take out yesterday’s trash.

- Flexible Move-Out Date: We work on your schedule. Whether you need to close quickly or require a few extra weeks to arrange your move, we can accommodate your needs.

When you’re ready to take control of your situation, request your fair cash offer for your San Antonio house with a tax lien.

See What Ron Had To Say About Working With Sell My House Fast SA TX

Frequently Asked Questions About Selling Houses With Tax Liens

Can you sell a house with a tax lien without paying it off?

Generally, tax liens must be addressed during the sale process. However, the lien can often be paid from the sale proceeds at closing rather than requiring upfront payment.

Will tax liens affect my home’s sale price?

Tax liens themselves don’t directly affect market value, but they must be paid from sale proceeds. Working with experienced buyers can help ensure you receive fair offers that account for lien resolution.

Can I sell my house during bankruptcy proceedings?

Yes, it’s often possible to sell your house during bankruptcy, but it typically requires court approval and coordination with your bankruptcy trustee to ensure proper handling of proceeds.

What happens if the tax lien amount exceeds my home’s value?

This creates a challenging situation requiring legal guidance. Options may include negotiating with tax authorities for reduced settlements or exploring bankruptcy protections.

How can I find out exactly how much I owe in tax liens?

Contact the relevant tax authorities directly – IRS for federal taxes, state revenue agencies for state taxes, and local tax assessors for property taxes. Request current payoff amounts that include all interest and penalties.

Selling a house with tax liens involves navigating complex financial and legal territory. It’s always wise to consult with professionals experienced in tax lien resolution and real estate transactions when handling these challenging situations.

Helpful Resources for Tax Lien Resolution in Texas

Navigating tax lien resolution in Texas requires access to reliable information and professional guidance:

- IRS Collection Information: Contact the IRS directly for federal tax lien information and resolution options

- Texas Comptroller: For state tax issues, the Texas Comptroller’s office provides guidance on state tax obligations

- Bexar County Tax Office: Local property tax information and payment options for San Antonio properties

- TexasLawHelp.org: Free legal information including sections on debt and financial difficulties

- State Bar of Texas: Professional referrals for attorneys specializing in tax law and bankruptcy

- Sell My House Fast SA TX: Experienced cash home buyers who understand tax lien complications and can provide solutions

Conclusion

Dealing with tax liens and the need to sell your house during bankruptcy in San Antonio, Texas, presents significant challenges. However, working with the right professionals can transform a difficult situation into a manageable solution.

The advantages of partnering with Sell My House Fast SA TX for properties with tax complications are substantial. As an experienced cash home-buying business, they simplify the process by addressing obstacles that typically complicate tax lien property sales.

Key benefits include:

- Speed: Fast closing timelines help prevent additional interest and penalties from accumulating

- Expertise: Professional handling of tax lien coordination and resolution

- Convenience: No need for property repairs or lengthy marketing periods

- Certainty: Cash offers provide reliable transactions without financing contingencies

When you’re ready to move forward with selling your property despite tax lien complications, consider contacting a trusted home-buying company in San Antonio. Their expertise in managing complex transactions ensures smooth property transfers even in challenging financial circumstances.

For individuals seeking solutions to sell their house with tax lien issues in San Antonio, Texas, the services of Sell My House Fast SA TX can provide the relief and results they need. Get a FREE, no-obligation, cash offer today and explore how we can help transform a difficult financial situation into a positive outcome.

You’re just one step from getting a FREE cash offer for your home!

Get a FREE cash offer on your San Antonio property today and move on from the headache of a stressful house.