Sell Your House Fast to Stop Foreclosure in San Antonio

Facing foreclosure is stressful and time‑sensitive. Every missed payment moves you closer to auction, credit damage and a deficiency judgment. We specialize in buying houses fast in San Antonio and surrounding communities. Our local team gives you a cash offer to pay off the lender, avoid the auction and move on without repairs or agent fees. Reach out today for a no‑obligation consultation.

Quick Action Steps

- Call now or submit your address to get a free cash offer within hours.

- Meet our local home consultant to review your situation, property value and legal options.

- Choose your closing date and collect your proceeds. We handle the paperwork with your lender.

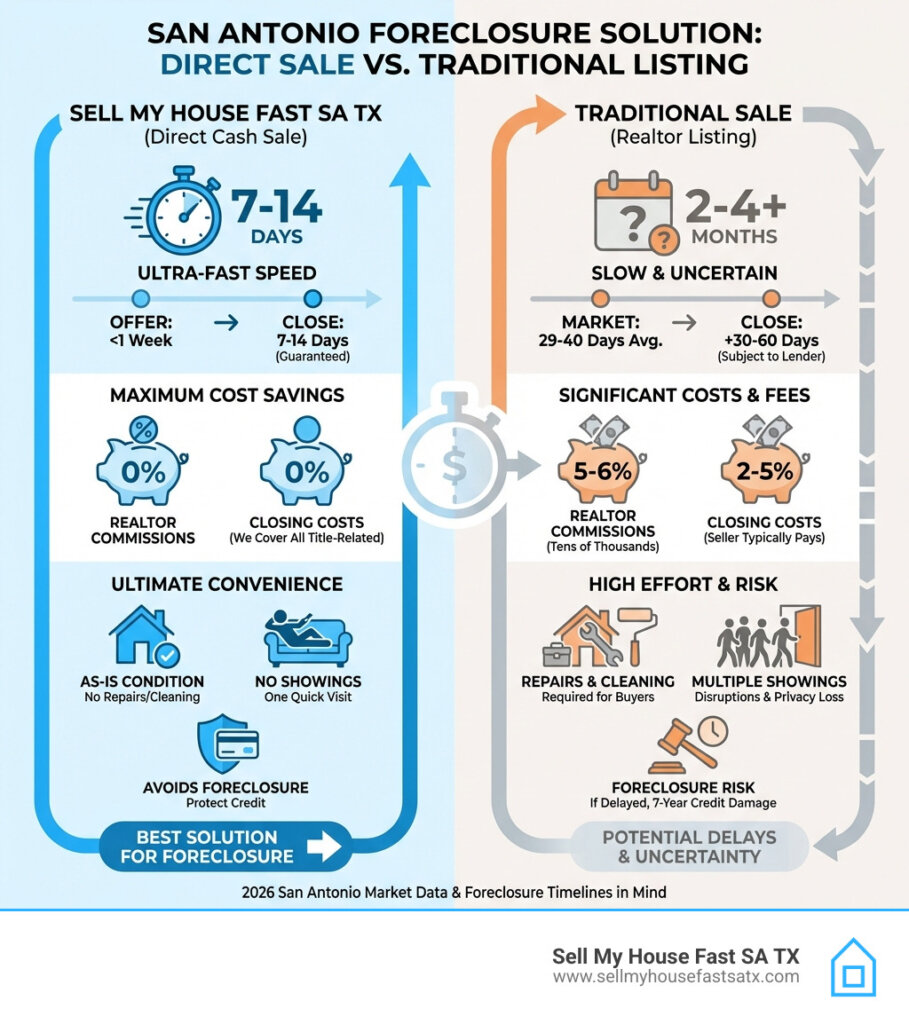

How Foreclosure Works in Texas

The foreclosure process in Texas moves quickly. Understanding the timeline helps you pick the right solution. Here are the key stages:

- Missed payments: After the third missed mortgage payment, the lender issues a notice of default and files a substitute trustee notice if your loan is non‑judicial.

- Pre‑foreclosure: You typically have at least 20 days to bring the loan current or negotiate with the lender. Failure to cure the default triggers the next stage.

- Notice of sale: The trustee records a notice of sale and mails copies to you at least 21 days before the auction. This notice is posted at the county courthouse and publicly advertised.

- Auction: On the first Tuesday of the month, the property may be sold at auction to the highest bidder. In Texas, there is no statutory right of redemption after a non‑judicial sale, so the home is gone once the sale occurs.

- Deficiency and eviction: If the sale price doesn’t cover the mortgage, the lender may seek a deficiency judgment. The new owner can pursue eviction if you remain in the home.

Different counties use judicial or non‑judicial processes. Always consult an attorney or housing counselor for personalized advice.

Your Options to Avoid Foreclosure

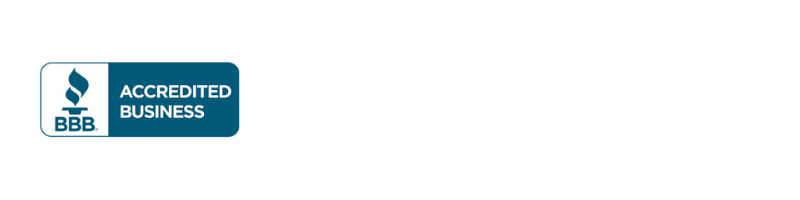

There is no one‑size‑fits‑all solution. Below is a concise overview of options to keep or sell your home. We help you navigate each choice and pick the right strategy:

- Sell to a cash homebuyer: Get a quick cash offer and close on your timeline. No repairs, showings or realtor commissions. Great when time is short or repairs are costly.

- List with an agent: Suitable if you have equity, time to market and can keep the house in show‑ready condition. Expect agent commissions and buyer financing contingencies.

- Loan modification or forbearance: Negotiate with your lender to lower the interest rate or pause payments; you must show financial hardship and future ability to pay.

- Refinancing: Replace your loan with a new mortgage at a lower rate; available only if you still have good credit and equity.

- Short sale: Sell the property for less than the mortgage balance with lender approval. This may affect your credit but prevents foreclosure.

- Deed‑in‑lieu of foreclosure: Voluntarily transfer ownership to the lender to satisfy the debt; may still affect your credit but avoids public auction.

- Subject‑to or lease‑option: Transfer or lease the property to an investor who takes over your payments. This creative strategy may preserve equity but requires a trusted partner.

- Bankruptcy: Filing Chapter 13 may temporarily stop the auction and allow you to repay arrears through a court‑approved plan. Consult a bankruptcy attorney.

Why Homeowners Choose Us

We are a local cash buyer dedicated to helping San Antonio homeowners avoid foreclosure. Our advantages go beyond a quick offer:

- Local expertise: We understand Bexar County foreclosure laws and have relationships with local title companies and attorneys.

- Fast cash: We buy with our own funds—no bank approvals—so we can close in as little as seven days or when you are ready.

- No repairs or cleaning: Sell the house as‑is; we handle inspections and repairs after closing.

- No fees: You pay no agent commissions, closing costs or hidden charges.

- Moving assistance: We can pay reasonable moving expenses and help coordinate your relocation.

- Privacy and respect: Our consultations are confidential; we respect your situation and never pressure you to accept an offer.

Our Simple Process

- Contact us: Call or fill out our short form with your address and contact details.

- Free consultation: One of our local specialists visits the property or does a virtual assessment, answers questions and gathers information.

- Receive your offer: We provide a fair cash offer based on current market values and the condition of your property. There is no obligation.

- Pick your closing date: If you accept, choose a closing date that works for you. We handle all paperwork and communicate with your lender.

- Close and get paid: Attend closing at a local title company and receive your payment via check or wire. Use the funds to pay off your mortgage and move on.

Real Case Example

A homeowner in the Alamo Heights area fell two months behind on mortgage payments after a job loss. The bank posted a notice of sale with an auction scheduled in 21 days. The owner contacted us, and we evaluated the property within 24 hours. We made a cash offer that allowed them to pay the arrears, satisfy the remaining loan and have money left for a deposit on a rental. We closed in 10 days and the homeowner avoided foreclosure and credit damage. Every situation is different; we tailor solutions to your needs.

Compare Your Options

| Feature | Cash Buyer | Listing With Agent | Foreclosure |

|---|---|---|---|

| Closing timeframe | 7–30 days | 60–90+ days | Depends on auction date |

| Repairs required | None | Must repair and stage | Not applicable |

| Out‑of‑pocket costs | None | Agent commissions, repairs | Missed payments and legal fees |

| Control over sale | Choose your closing date | Dependent on buyer financing | No control; auction scheduled |

| Impact on credit | Settles debt quickly | Depends on sale speed | Severe, long‑term damage |

| Avoids deficiency judgment | Yes if loan is satisfied | Yes if sale covers debt | Uncertain if sale proceeds are low |

Don’t just take our word for it, see what our satisfied clients have to say!

“Brett Favre here with Sell My House Fast San Antonio – where every second counts. They offer precision, expertise and a strategy designed to San Antonio’s unique market. They guarantee a fair and fast no-obligation cash offer without delays. Step off the sidelines and into the game with Sell My House Fast San Antonio Texas for a swift sale. Give them a call at 210-951-0143“

– Brett Favre

We are also featured in:

Frequently Asked Questions

Can I sell my home after receiving a notice of sale?

Yes. You can sell your home at any point before the auction, as long as you satisfy the mortgage and any liens. A cash sale often provides the speed needed to stop the auction.

Do I need to be current on payments to sell?

No. We routinely buy houses that are in arrears or in the foreclosure process. Our offer accounts for the outstanding balance, taxes and fees owed to the lender.

What happens if my house is worth less than my mortgage?

If the sale proceeds will not cover the mortgage, we can help negotiate a short sale or other creative solution. Lenders sometimes accept less than the full balance to avoid foreclosure.

Will you negotiate with my bank?

Yes. Our team works with lenders to obtain payoff statements, postpone auctions and facilitate a smooth closing. You should also inform your lender that you are working on a sale.

Are there any fees or commissions?

No. We pay all closing costs. You will not owe real estate commissions or hidden fees when selling to us.

Is your offer obligation‑free?

Absolutely. Our offer is free, and you are not obligated to accept it. We provide information so you can make the best decision.

Areas We Serve

We buy houses throughout San Antonio and nearby communities. Whether you are in Alamo Heights, Helotes, Boerne, New Braunfels, Schertz, Universal City, Converse, Kirby or Live Oak, we can help. If your city is not listed, contact us—chances are we’ve purchased homes in your area.

Helpful Resources

If you need more information about foreclosure prevention and homeowner rights, consider these organizations:

- HUD – U.S. Department of Housing and Urban Development: guidance on avoiding foreclosure and approved housing counselors.

- CFPB – Consumer Financial Protection Bureau: information on mortgage relief programs and your rights.

- NFCC – National Foundation for Credit Counseling: free credit counseling and debt management services.

- Texas Rio Grande Legal Aid – legal assistance for low‑income homeowners facing foreclosure.

Take the First Step Today

Foreclosure doesn’t have to mean the end of your financial future. With the right partner, you can sell your house fast, avoid an auction and move forward with dignity. Reach out now for a free, confidential cash offer and explore your options.

You’re just one step from getting a FREE cash offer for your home!

Get a FREE cash offer on your San Antonio property today and move on from the headache of a stressful house.